In our 30 plus years as pricing strategy consultants, we have never noticed such a strong focus, from companies, on pricing. To be fair, it was already an expanding discipline, but with the economy still struggling to gain traction, the pricing discipline is attracting even more attention.

During normal economic times, a 1% pricing improvement typically delivers about a 12.5% improvement in profit, but that assumes you are making a bottom line profit of 8% (profit/sales). However, during a recession, the pricing improvement can jump to 20 to 25% or more, if your profit drops to 4% or 5% of sales, as it has on average for companies during the recessions in the early ‘90s and earlier this decade.

Now, more than ever, companies must manage pricing prudently and effectively in order to maintain positive ROI. To help them do so, many new tools have emerged. Companies are developing their own sophisticated pricing tools and some of the software firms are developing “on demand” versions of their software that are affordable for smaller companies.

Another important pricing enabler is market research. By combining the appropriate research method with technology, statistics, and economics, companies can do something that has historically never been possible—create powerful price/volume forecasting models.

The catch is that using a research method does not guarantee accuracy in your model. In other words, just because you have a golf club, it doesn’t make you a PGA professional. With pricing models, as in golf, it doesn’t take much to land “out of bounds.”

Case in Point

The following chart shows the impact of raising the price of a product 10% when the price elasticity is assumed to be either -0.8, -1.0 or -1.2. [Price elasticity is a ratio of the percent change in volume divided by the percent change in price.] The effect on the bottom line is dramatic, ranging anywhere from a modest 4% increase to a substantial gain of +36%. Like golf, being just a little off can make a big difference to the outcome.

But do these erratic results mean that pricing research is a fool’s game that can never be accurate? On the contrary, our experience has shown that conducting pricing research is an excellent idea 90% of the time. In the other 10% of cases, the product or buying process is so complex that it renders traditional quantitative methods ineffective.

There is plenty of evidence to prove that pricing research can be highly accurate when designed and managed well.

An Example

One CPG company executed a pricing research study and used the data to influence the retail channel to adjust prices. One of the retailers did not believe the results, and ran a six-month in-store test in 100 U.S. stores to “prove” that the research results were incorrect. Instead, the test validated the research results completely and unequivocally.

Why is pricing so sensitive? How does it differ from other methods of research? The key difference is that pricing research reverses the goals of the traditional research. Most market research focuses on identifying what the customer wants (e.g., new product development), how he or she buys (U&A), or how satisfied he or she is (Customer Satisfaction). Pricing, on the other hand, focuses on how much the customer will give. Customers are happy to tell you what they want, but they typically don’t want to tell you what they are willing to pay. That is why direct questioning is so ineffective in the area of pricing.

Therefore, we try to live by different design rules. Here are two of the most important ones:

1. Select the Correct Pricing Tool

For example, one study of a liqueur showed high elasticity. However, the company had powerful historical evidence to suggest that consumers were price-insensitive. It turned out that the research was incorrect. The study had used BPTO (Brand Price Trade-off Analysis), a method that asks respondents to indicate their commitment to a product as the price is steadily increased. Consumers quickly figured out that showing a low level of commitment would probably get them lower prices for their favorite liqueur, and so they overstated their price sensitivity.

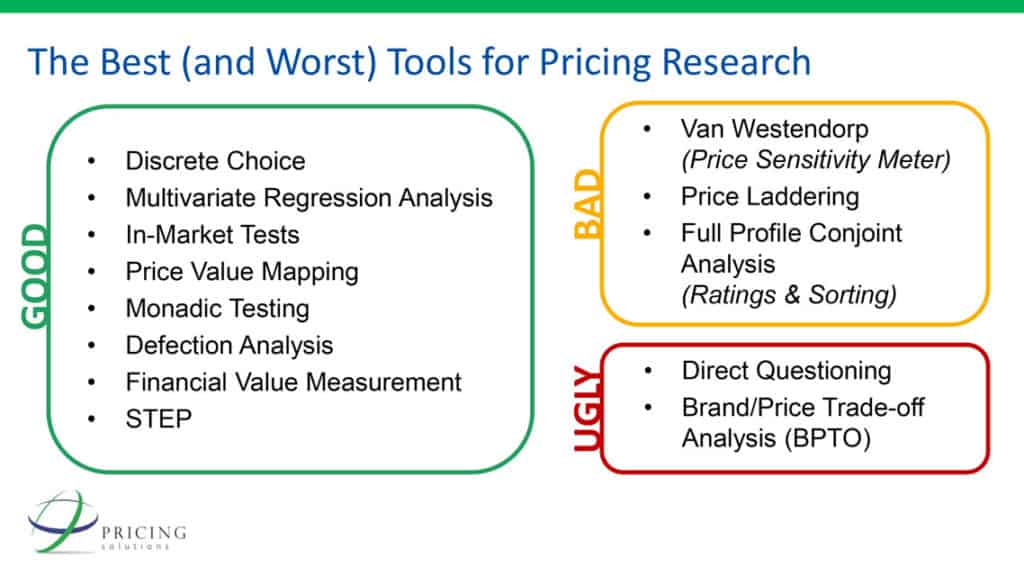

There are many different approaches to using pricing research for generating positive ROI, and many of them are ineffective. The following Table summarizes our view of “The Good, the Bad, and the Ugly” when it comes to collecting data.

2. Only Do Quantitative Pricing Research When You Can Effectively Recreate the Buying Experience/Process

The design must be realistic and consistent with the buyer’s actual buying process. If you ask someone to engage in a simulated purchasing exercise and you don’t re-create the experience to actually reflect how he or she buys, then you can almost be certain that the results will be misleading. For example, we recently conducted research in the denim category. We realized that an online study would not work because, to fully understand the product’s value, people had to touch/feel the product, and even try it on if they wanted to. However, in other consumer categories, touch and feel are less important. Take, for example, credit-card selection. Brand, rewards, security, interest rate, etc., are all attributes that can be effectively assessed over the Web.

Assuming the research can be designed in a way that is likely to yield accurate results, the next step is to ensure that it has, in fact, done so. That’s why quality assurance is critical with pricing research.

How do you know if you have a predictive model? You can never be 100% sure until you have actually tested it in the marketplace, but there are a number of ways in which you can reduce the risk of the model being inaccurate. One of the specific QA techniques we have developed measures the actual consumer choice share versus the predicted share. This process can reveal significant gaps between the model and the choices made by consumers. Often, the gaps are caused by a product crossing pricing thresholds where a “tipping point” in consumer demand has occurred. Models do not necessarily capture consumers’ irrational behavior, but this insight can be critical to the client’s pricing decision.

The final, and most important, step in improving ROI is to ensure the research makes an impact. Too often, pricing research is relegated to the marketing team and does not make it out to the sales team, or the organization does not have the pricing management processes required to ensure the successful execution of a new pricing strategy.

Excluding the sales force is a mistake. The sales force has to communicate the price/value proposition of the company and sharing the pricing research with them is a critical step in building their confidence in the overall pricing strategy.

If a company does not have its internal pricing management processes (i.e., price change execution, discounting, and trade spend management) in order, it will have only a limited ability to successfully apply and leverage the consumer insight provided by the pricing research. From our experience, this is the case for approximately 70% of companies. To generate a positive ROI from pricing research, a company really should be operating at Level 3 of the World Class Pricing™ Process Maturity scale. Not sure where your organization falls on the Process Maturity scale? Read our article “Finding Your Pricing Strategy on the 5 Levels to Pricing Improvement“.

Firms that are world-class pricers involve the sales, finance, research, marketing, and, more and more, the internal pricing teams in the development and application of pricing research.

While there are risks in doing pricing research, companies who use the appropriate methods and tools, and get the different functional areas—especially sales—engaged will score birdies instead of bogies.