Building a Robust Pricing Structure

May 2009

Section I.

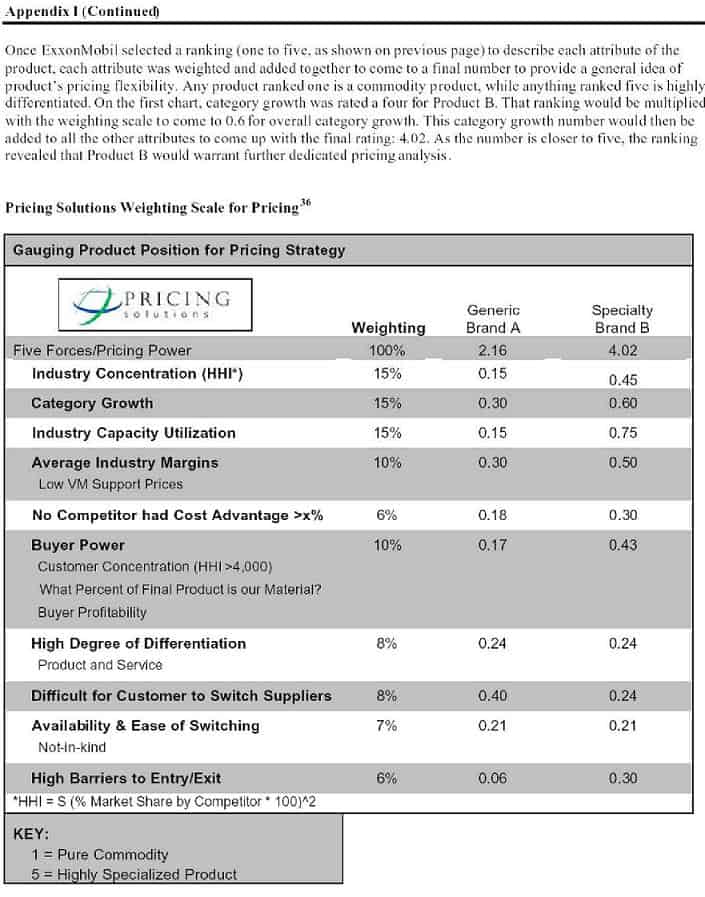

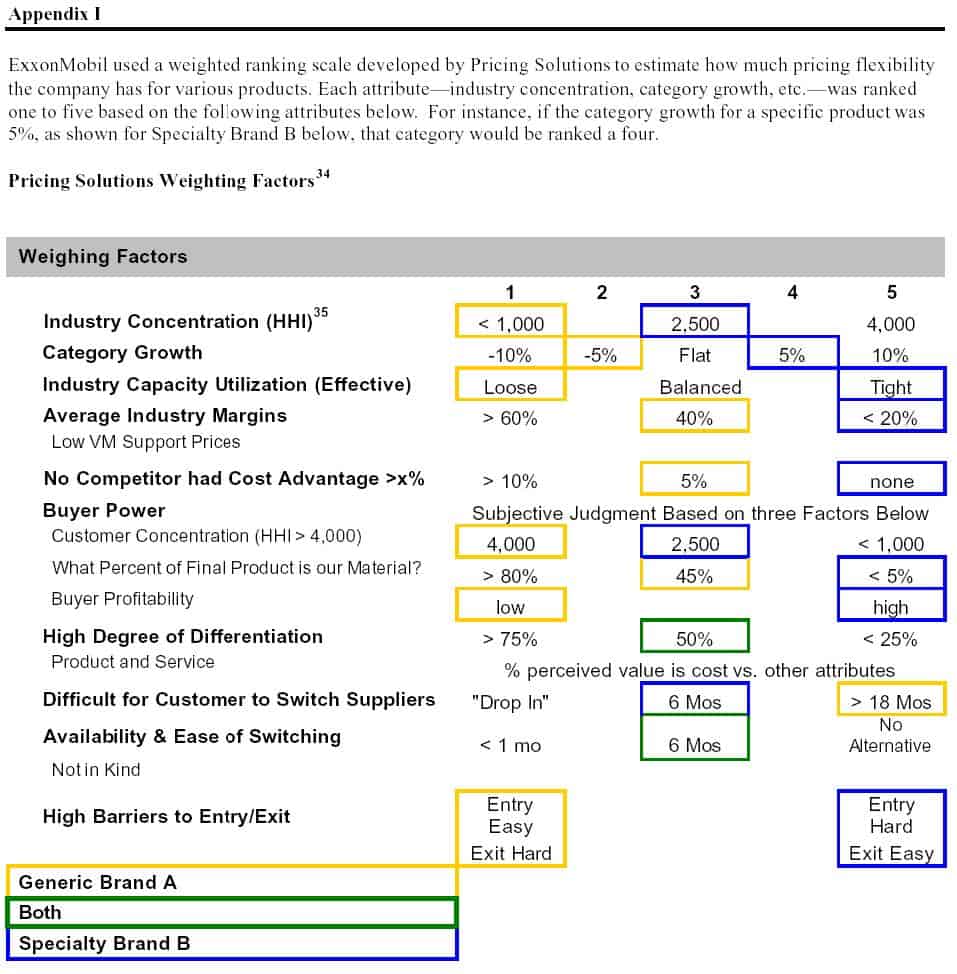

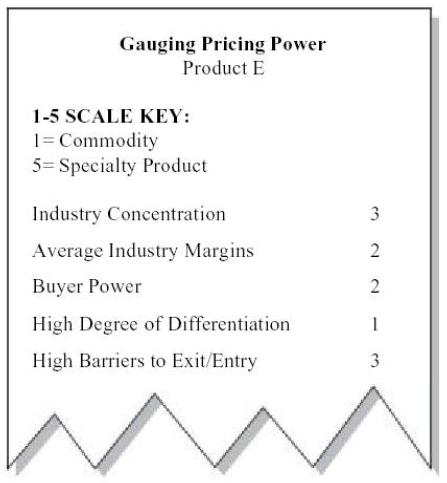

While it may be simple to gauge some products as “specialty” or simple “commodity” based on a quick overview of these characteristics, many products fall in a grey zone where it’s not clear how much value a firm may garner from the product. To tackle this problem, Exxon Mobil Chemical used a model created by Pricing Solutions to quantify these and other features to see where to focus their pricing efforts.

Exxon Mobil Chemical ranked key attributes—such as industry concentration, buyer power, degree of differentiation, and seven other attributes—on a scale from one to five to see how much pricing flexibility the company had for various products . Once all the attributes were weighted, any product ranked closer to a one was considered more of a commodity, while products leaning toward five were more specialized. Exxon Mobil Chemical then implemented value-based pricing first on more highly specialized offerings and used simpler models for other products. (See Appendix II for a more detailed overview of Pricing Solutions’ model.) Using a simple template, a well-informed manager could complete the review of four to five products on one working morning. Based on this quick and simple assessment, the company began narrowing down products to focus on.

Section II.

To successfully sell to clients, the company should know its product or service will affect its clients and be able to communicate that to the client. In order to gauge the ultimate benefit to the client, various companies have found it useful to run through their customers’ income statement and see where—via their offering—their clients are affected. It’s important to know how the client makes money (or measures value) and how the firm’s solutions deliver value to those areas. In order to gauge the ultimate value to the client, a firm may look at the income statement and ask questions such as the following:

Will this offering:

- Help run a plant faster?

- Provide features to expand market share?

- Reduce product returns?

- For all of these, ask: how much?