Modular Pricing White Paper

“The biggest obstacle to implementing modular advertising is the fear of

venturing into the unknown. This fear can be overcome using sound modeling and

analysis, as well as engaging with management teams and customers to develop a

well thought out and effective modular rate card.”

‐ Pricing Solutions Ltd.

Introduction – The Initiation Phase

“Where can we improve?” is a question that is leading the charge for change within the newspaper industry. Modular advertising is often a topic of such discussions, despite differences in opinions about the benefits and risks associated with this pricing practice. The term “modular” itself indicates that ad space is offered based on fixed unit sizes (modules), as opposed to providing endless flexibility for advertisers to choose any ad size using line‐rate pricing strategies. So why would a newspaper want to limit an advertiser’s options for ad sizes, you might ask?

We see a number of benefits with Modular Pricing:

Provides an alternative pricing strategy to line rates. Line‐rate pricing strategies often fall into a yearly increase (e.g. 4‐5%). This contributes to the longer‐term “catch‐22” as advertisers buy smaller, lesseffective ad sizes over time. Modular pricing, on the other hand, allows each module unit to be priced as a separate product offering. Not all modules need to receive the same net line price point; in this case, a new pricing strategy is being used, since different modules can be priced to drive different purchasing behaviors.

Encourages desired ad sizes and discourages unwanted ad sizes. “Page busters” can often take premium ad locations, especially within Section “A.” That means a lost revenue opportunity if that particular location could have housed a full‐page advertisement instead. Modular layouts offer an opportunity to charge a premium for or omit such unwanted sizes.

Lowers cost structure and/or improves efficiency. Modular layouts can help simplify both the layout and selling process, reducing costs and making more efficient use of internal resources.

Potential to reduce pre‐priced tickets / Non‐Standard Rates (NSR). Sales reps can often override invoice amounts by rounding down net totals resulting from line‐rate calculations (e.g., NSR an ad to $4,000, as opposed to $4,244.26 calculated using line rates). NSR ads can undermine business analytics because they often hide the impact of value‐added offerings that include color, page guarantees, Section A premiums, etc. Because modular units can be priced at specific psychological price points, sales reps are less inclined to override the module pricing, which reduces the number of NSR ads.

Addresses the issue that all ads are not created equal. Advertisers realize different benefits for ads of different sizes. Line rates infer that value is a linear function of space. Research has shown that this is not the case. Do we need to quote the research?

Simplifies and improves the layout/appearance. Readership surveys have indicated that readers prefer a cleaner, clutter‐free layout. Modular advertising can enhance the overall appearance of the newspaper, thus improving the experience for the reader.

Enhances effectiveness of advertisements. Modular units provide a simplified stacking approach for advertisements. Non‐modular ad stacking, by contrast, often results in a cluttered appearance that potentially devalues an advertiser’s content.

Modules can be priced to encourage size upgrades. Using a non‐linear relationship between the size of the ad and the price, newspapers can create financial incentives for advertisers to behave in ways that will make their ads more effective and at the same time make the paper easier to read. For example charging a premium for page or half page dominant ads will discourage their usage.

Using modules can provide an opportunity to more fully capture color premiums. Many newspapers have made significant investments in their color facilities as they continually strive to improve their value‐add with advertisers. Unfortunately, in many cases, color is used as a negotiation tool, and premiums can be discounted or over‐ridden entirely. Using color modules that are priced separately from their B&W module counterparts can improve profitability by more fully capturing the benefits of this value‐add.

Many newspapers are already using modular advertising, particularly within the European market, which is gradually becoming standardized with smaller‐size formats (i.e., Berliner, tabloid/compact formats). However, even though the concept of modular pricing has been around for a while, many newspapers still have a lukewarm response to it. Can modular advertising truly increase revenue? Would advertisers scoff at the lack of flexibility to determine their own ad sizes? There are definitely conflicting viewpoints about the benefits of this practice.

From our experience, we believe switching to modular advertising is most effective in the following situations:

- When there is a major change to the format of the paper. Many European papers have downsized the page size to reduce print costs and satisfy readership preferences; a few North American newspapers have followed suit. But with a reduction in paper size comes a reduction in total lineage per page—a recipe for lost revenue unless line rates are increased accordingly. Line‐rate increases can be a difficult conversation with advertisers and agencies. As many European papers have discovered, modular advertising can help avoid these obstacles by simplifying the offering. Regardless of physical page dimensions, modules that are sold as a percentage of page coverage (e.g., 1/8 page, ¼ page) will show no change in pricing if newspaper format changes.

- When re‐aligning line rates with changes to column widths and heights. With an aging readership, many newspapers are considering moving to fewer columns, as well as the possibility of increasing font sizes. Similar to downsizing page dimensions, column reductions and fewer lines per column also result in an overall drop in lineage per page. Line rates would need to be increased to salvage revenue, which, again, can be a difficult conversation with advertisers. While in this case, the physical ad dimensions and net price for advertisers might remain the same, there is still the perception that line rates are increasing. Modular pricing helps remove the negative impression that might otherwise have been associated with increases to these line rates.

- When there are several competitors adopting modular advertising. If more newspapers transition to standard modular sizes, advertisers will produce ad materials to match standard modules. Differing web widths is one impediment. Selling ads based on value not size is the other. Modular advertising is common in the European market. If, however, your paper is the lone wolf, modular pricing can be present some additional challenges. Advertisers will require an introduction to the new approach, and may initially see it as more complex compared with today’s line‐rate structures.

The biggest challenge we see is that given different press sizes, even industry standard modules will not mean industry standard sizes. Advertisers complain that they still need to adjust ad copy to fit the modules of different papers. We believe this is an area where The Industry Association could help.

Whether or not your organization should transition to modular advertising will ultimately depend on your corporate strategy, long‐term objectives, and an assessment of the risks and benefits (i.e., investment considerations for billing and accounting systems changes). Modular advertising might not be for everyone, but those who do decide to implement it should take a rigorous analytical approach to ensure that module sizes are carefully selected and well‐priced, and that they provide an opportunity for growth while minimizing financial risks.

Building the Modular Pricing Roadmap

Building a roadmap is an excellent starting point to ensure the path to implementation is free of both roadblocks and bottlenecks. The process begins with a vision, defining goals and objectives, and building short‐ and long‐term timelines. It is critical at this point to fully engage management and categorymanager teams, for two reasons: they can help bring an understanding to the modeling and analysis; and they need to buy into the overall process, since they will ultimately be selling the modular rate cards. The higher the participation of the advertising managers, the greater the likelihood of a successful implementation.

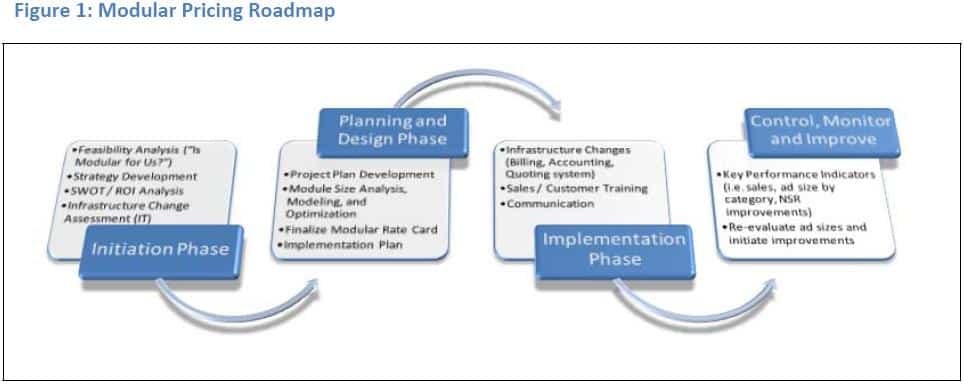

The Initiation phase is crucial, as it helps determine the feasibility of implementing modular design, based on estimated financial payback and strategic analysis. In addition to the strategic considerations posed above it is important to understand: How much will it cost to alter the billing, accounting, and quoting systems? Will cost savings and potential revenue growth using modular pricing provide ample return on investment (ROI)? The Planning and Design phase integrates managerial feedback, as well as modular modeling, to optimize profitability, estimate and minimize risk, and develop the desired modular rate card. The Implementation phase involves changes to various systems (billing, accounting, and sales quoting), as well as updates of marketing materials, communications (sales message and plan for overcoming objections), and sales training. This is also a key stage to communicate both internally and externally about the transition to modular rate cards. The final phase is Control, Monitor and Improve. There are always hiccups, and, as many modular‐based newspapers discovered, it was necessary to make changes to some segments in order to strive for improvement and maintain healthy advertiser relationships.

The Need for Modular Analysis: What Happens to Revenue and Profitability?

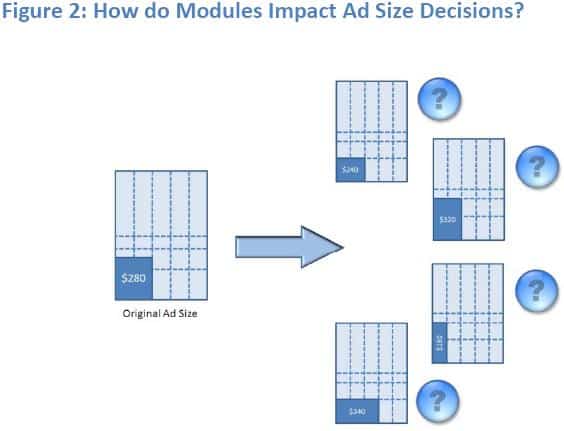

Throughout the Planning and Design phase, it is important to understand the current and historical purchasing behaviors of advertisers in order to develop a sound forecast model that will analyze possible behavior changes with modular pricing (Figure 2). During this process, newspapers will need to address key questions within the model, including:

- How are customers expected to migrate from endlessly flexible ad sizes to fixed module sizes?

- How will module price points influence purchasing decisions from one module to the next?

- What is the impact of limiting the number of available modules?

- What if the number of available modules varies by section or by page locations (e.g., only a half or full page is available for Page A3)?

- How do module sizes impact categories (e.g., automotive, movie distributors, small retailers)?

- How will modular pricing impact your anchor tenants (i.e., large contract accounts)?

- What is the best approach to assessing best, expected, and worst‐case scenarios?

- Which accounts will incur price increases, and which will benefit from price decreases (Winner & Loser Analysis)?

It is essential to involve the management team as well as the category managers in the Planning and Design phase. Besides helping to answer the above key questions, category managers will provide muchneeded feedback and voice additional concerns that might otherwise have been overlooked during the module rate development.

From our modeling experience, we have found it highly useful to model best, expected, and worst-case scenarios. As well, top-line considerations identified during the Initiation phase can help steer your modeling scenarios. For example: Are you looking to break even with modular pricing? Drive additional profit growth? Increase ad frequency? In these cases, a pricing strategy is directly related to your business and category strategies.

Modular Pricing Strategies

There are several approaches to modular pricing; which one works best will depend on the newspaper’s customer base and strategy.

Option 1: Keeping it Simple with Linear Modular Pricing

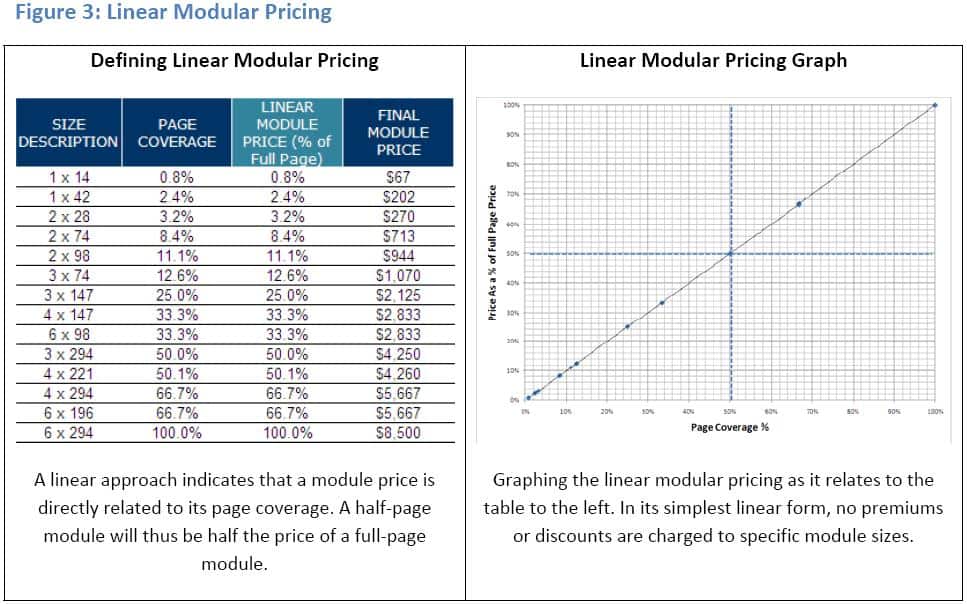

Linear modular pricing maintains a pricing format similar to that used with line‐rate pricing. Regardless of the ad size, the total amount owing is calculated by multiplying the line rate by the line count. The difference with modular pricing, however, is that the advertiser has only a select number of ad size options from which to choose.

Advantages to this technique include the ability to manage ad sizes (e.g., limit “page buster” ads), and to indirectly encourage customers to upgrade to larger sizes. A limitation to this approach is that modules don’t receive psychological price points since these are dependent on linear price points.

This pricing strategy might be useful if there are serious concerns about advertiser backlash from changing basic line rates, or if there is a desire to use a phased approach to modular pricing while still using a line‐rate‐type pricing concept. But then, why consider doing this in the first place? This is a classic example of being “neither fish nor fowl,” since the paper is not fully benefiting from a modular strategy (i.e. pricing for value), and yet it is giving up some of the benefits of a line pricing strategy (i.e.,flexibility).

Option 2: Using a Combination of Line Rates and Modular Rates

At times, a modular newspaper may opt to continue offering line‐rate options if there is a strong resistance from advertisers to the transition to modular units. A Canadian national newspaper offers a modular/line‐rate combination (termed “MALs,” defined as Modular Agate Lines) that uses module sizes while still pricing its general rate cards with standard line rates. This approach might encourage customers to use a fixed‐size format while still using line rates as the reference price point.

The strength of this option is that it moves to modular while still allowing customers who want unique sizes to have access to them. The problem is that this slows the implementation of modules and creates inertia among customers and the sales force, who may feel that if they complain enough, the company will pull back on its modular initiative.

One way to overcome this resistance is to charge a premium for any non‐standard size (i.e., not a module). This allows advertisers to decide for themselves whether the value of a non‐standard module is worth it.

However, this can create problems with large customers who are used to getting what they want (i.e., size and price). Therefore, be prepared to negotiate with contract customers who feel strongly about their need for flexibility.

By keeping modular intact for all but the largest customers, newspapers will reap the benefits of it for a large proportion of their business.

Option 3: Using Optimization Curves to Determine Module Prices

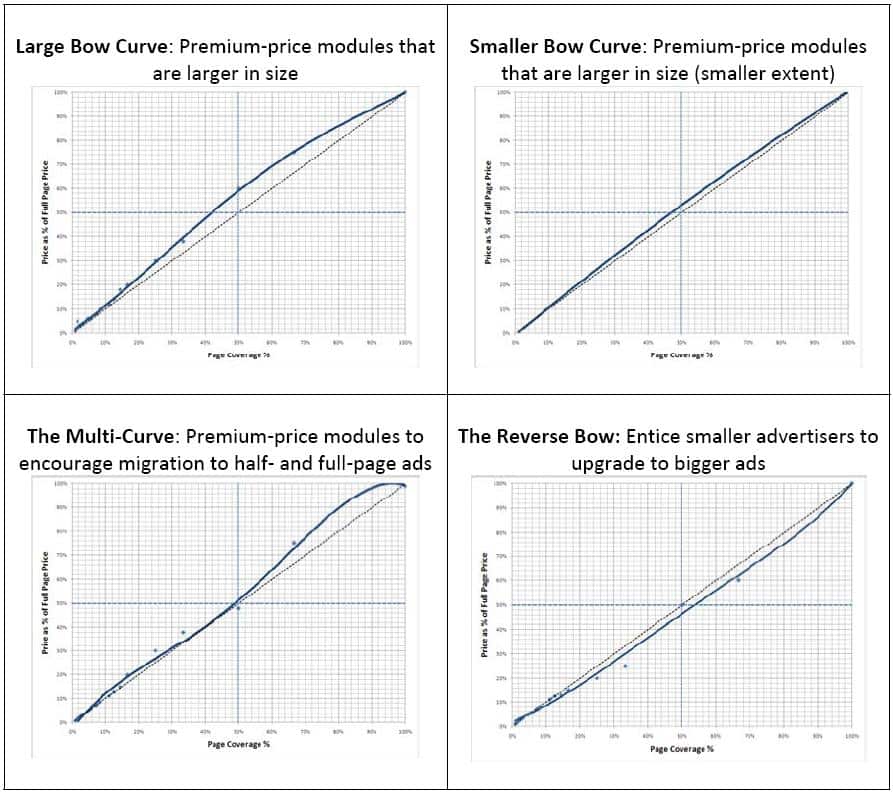

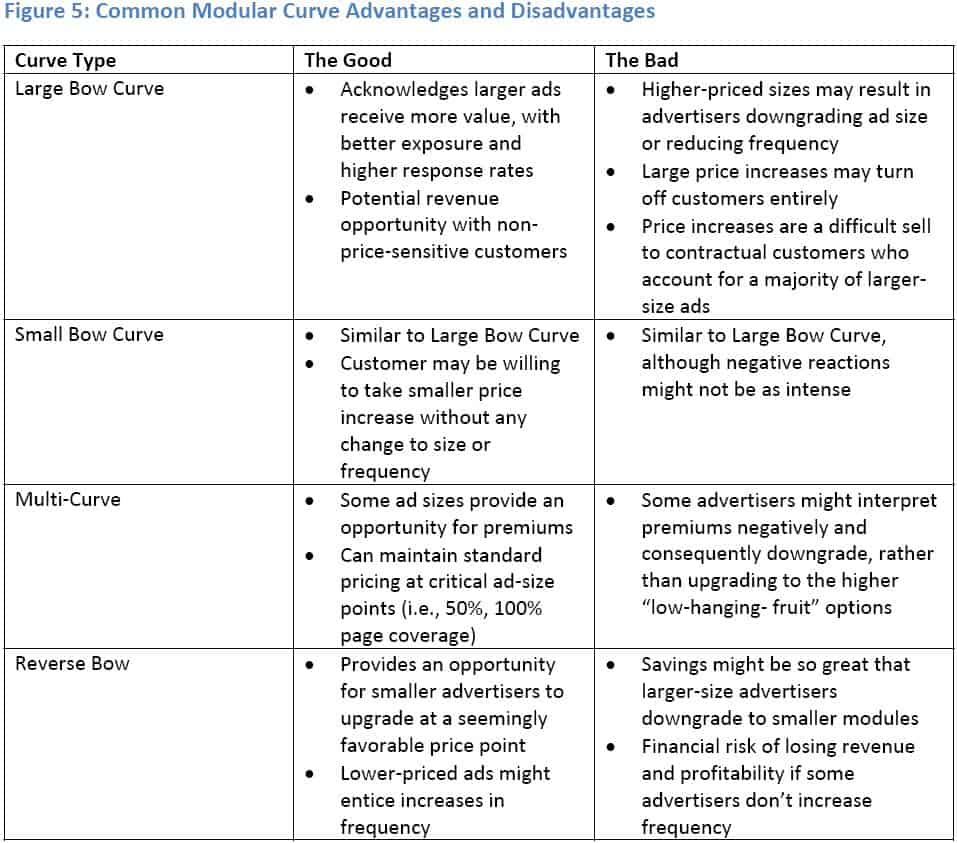

The use of modular price curves (Figure 4) will likely be a main point of interest for many who are planning to implement modular formats. Key questions will arise from using various curves, including: How does one optimally price module units to ensure there is growth in revenue, profitability, and ad sizes? Or, from a financial risk standpoint, one might ask: How can module prices be used to ensure there is no decrease in ad sizes and no drop in frequencies while also ensuring that advertisers remain loyal long‐term customers? It is important to make use of modeling and analytical skills in order to determine an optimal modular curve that best reflects anticipated customer reactions.

An exciting and unique approach, modular curves require a “paradigm shift” to think beyond standard line rates. Each module is now treated as if it were its own product, with its own price points that cater to specific advertiser segments and behaviors. In this case, a ¼‐page ad will not necessarily be priced as ¼ of a full‐page; it will be priced to encourage upgrades with some advertisers while preventing downsizing with others.

The key to understanding which modular curves work best is to understand how your advertisers purchase today, and anticipate how they will purchase with the new modular formats. Not all newspapers are the same, and not all advertisers are the same. What works for one newspaper might not be applicable for another.

Figure 4: Common Modular Pricing Curves

It is important to realize that different curves drive different behaviors. Which behaviors you want to drive will ultimately depend on your current account base. Perhaps as a small community paper, you want to encourage more half‐ and full‐page ads. In this case, the Multi-Curve might be a favorable option—providing discounts for half-and full‐page modules while premium-pricing neighboring modules. Or maybe there is a need to entice smaller advertisers to increase their ad sizes. The Reverse Bow may provide the incentive needed to encourage ad size upgrades at minimal incremental prices. Regardless of which module strategy you use, it is important to model and analyze how accounts potentially will react to your new module designs and rate structure. From our experience, we have found it highly useful to use varying ranges of reactions that provide a best, expected, and worst-case outcome.

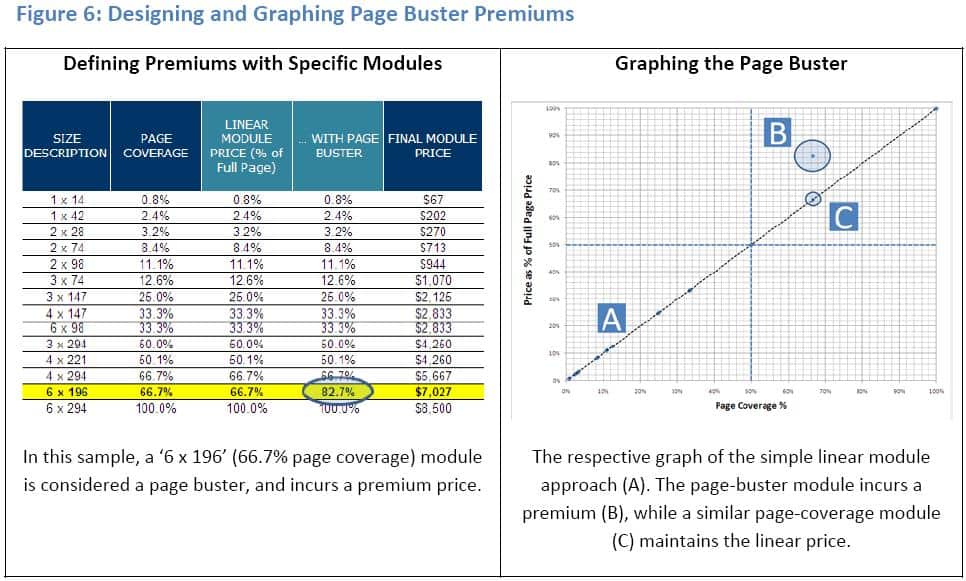

Premium‐Pricing Specific Modules (aka “Page Busters”)

One of the benefits of modular pricing, noted in the opening remarks, is the potential to encourage desired ad sizes while discouraging unwanted ones, such as “page busters.” A page buster is defined as an advertisement with a cost opportunity for taking premium space that could have been allocated to larger ads (i.e., full-page ads). Many advertisers use page busters because they perceive that a nearly full-page ad provides equal value to a full-page ad, and at a lower price. Some advertisers will argue page busters provide more value, since these ads are usually bordered with editorial content. For advertisers, this opens the possibility that more readers will peruse their ad content. For the newspaper, however, it may mean forgoing a higher‐revenue full-page advertisement within that page, especially within premium page locations that include Section A.

By premium-pricing page-buster modules, newspapers can still allow advertisers to select this particular size (an alternative is to remove this module option entirely), but the module is priced to account for the opportunity cost of such ads. It would be difficult to charge such a premium using standard line rates, thus reinforcing the advantages of modular pricing. Another advantage to premium-pricing page busters is that it encourages advertisers to upgrade to full-page ads at a seemingly small incremental price.

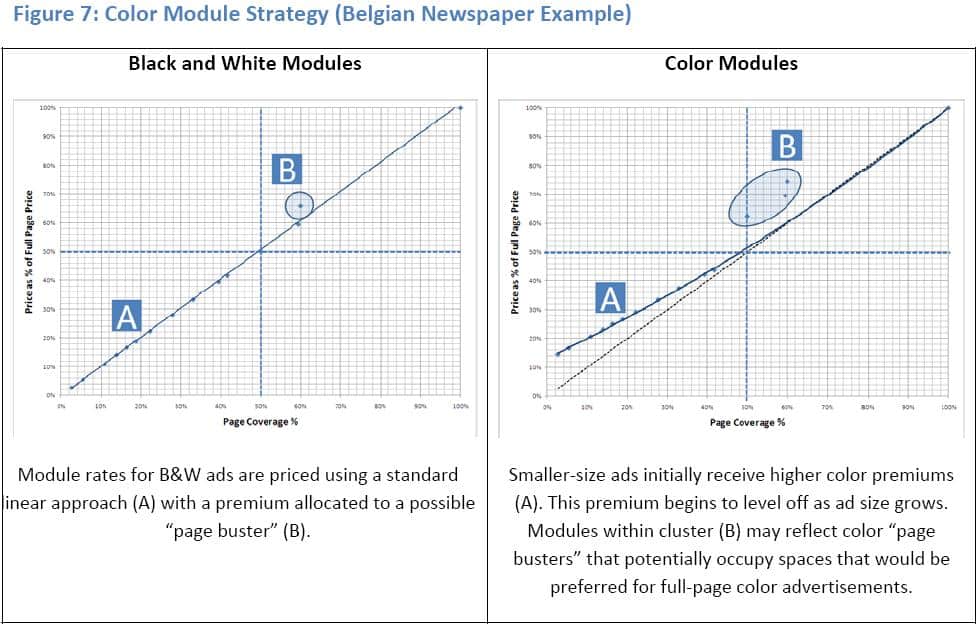

Color Modules: an Opportunity to Optimize Your Value-Add

Many line-rate cards currently price color using a premium (e.g., +20%) or a fixed-fee amount (e.g., $8,000, regardless of ad size). There are pros and cons to both approaches. Premium percentages help capture some additional color revenue with smaller ads, but as most ad managers are aware, they can be overridden (NSR) or used as a negotiation lever. Alternatively, fixed color fees can capture large revenue sums with bigger color ads but disregard the potential to capture color fees with smaller advertisers. Choosing to price color modules can help overcome some of these disadvantages.

As many European newspapers have discovered, modular advertising can provide a significant opportunity to more fully capture the value of color. One large Belgian paper has taken an interesting approach that involves using two price points for the same modular size: one price point for B&W, and the other for color (Figure 7). More importantly, the curves used for B&W and color are different, thus driving different purchasing behaviors for B&W and color advertisers. This acknowledges differences in B&W and color purchasing behavior; a well-built model will factor in both scenarios in order to fully optimize both revenue and profitability.

Additional Analytical Considerations

Many standard line-rate cards (i.e., National, Retail, Local Retail) have modified rates for special categories. Rates can even indirectly be adjusted with premiums and discounts based on value-offerings or incentives to drive certain ad behavior (e.g., improve ad frequency). There are many levers that can influence standard line rates, and it is important to address all of these and related modified rate cards when evaluating modular pricing. From our experience, these levers can easily be overlooked during the modular planning process, and will require detailed analysis and well thought-out plans to ensure they align correctly with modular strategies. A list of potential considerations includes:

- Frequency programs

- Pick-up programs

- Unique modules (e.g., front-section banners, ear lugs, double trucks, etc.)

- Page location (e.g., Page 3, section back page, etc.)

- Page guarantee premiums

- Day of week (DOW) pricing

- Zone pricing

- Contracts

- Special umbrella sub-sections

- Sectional pricing

- Subsidiary newspaper pricing (all on board with the same format?)

Implementation Considerations

Transitioning to modular pricing is a significant undertaking, since its impact will extend well beyond the advertising department. Billing, quoting, and accounting systems will need to be updated, which will affect the entire organization. These implications need to be considered during the Planning and Design phase to set realistic expectations for timelines.

Strive to “keep it simple.” Make it as easy as possible for your clients to understand the transition from line-based pricing to modular-based pricing. Send out material prior to launching the new structures. Set aside time to discuss this well beforehand with key clients. Keep in mind that if customers find it overly confusing to understand the new controls and price structures, they’ll shop elsewhere.

One option is to create a simple-to-use calculator and make it available on your website. Many levers can impact pricing, including modular size unit, frequency, category, section. There will be a requirement to quickly and easily calculate the pricing for a particular modular unit.

Identify the categories at risk. Certain categories will present at a higher risk than others (e.g., National accounts, Movie Distributors). Obviously, if an entire segment of customers or a particularly large one is threatening to withdraw their support from the paper due to modular, then you will have to show some flexibility. These risks can usually be anticipated and contingency plans made to prepare for such situations.

Train your staff to sell the modular “value story.” The value of the paper is primarily in the reach and quality of audience it brings to advertisers. Modular is a discussion that usually occurs much later in the sales process, once the advertiser is convinced of the benefits of advertising with your paper. The key to ensuring a smooth transition to modular is to prepare the sales team properly. If they are apologetic and lack confidence about modular, then they will be less successful in selling it.

Prepare a plan to handle customer reactions. In a perfect world, modular implementation would be received with smiles and compliments from all advertisers. But the reality is there will be some advertisers that will be weary of change and will complain. However, complaints can actually be viewed as “opportunities” if you have a well thought‐out plan that listens to and addresses their concerns. In this case, being able to sell the modular “value story” is key. It is also necessary to address questions such as “What is your internal escalation plan?” or “Is there a pattern in the complaints that highlights a risk in certain categories?” in order to reduce surprises and minimize loss of customers.

Take time to listen to and train your customers. Prior to implementation, it may be beneficial to test the waters by getting feedback about your modular designs from various‐sized advertisers. Listening to your customers can help you make adjustments where needed and explain concepts that might be negatively perceived by them. Training customers is also critical to ensure there is no confusion about how they determine their pricing (online calculators help remove complexity).

Closing Remarks

Modular pricing offers an opportunity for improved profits and operational efficiencies. However, given that it is difficult to build a related value story i.e. that advertisers will benefit from modular advertising, it will be a tough sell. While modular offers the potential of standard ad sizes in theory, in practice the myriad of page sizes means advertisers will still likely have to vary their content to fit the modules of different papers. Modular can be a success when there is leadership to create standardization. In Europe leadership came as papers converted to a markedly different page format (Berliner presses). One client pushed ahead because they believed they could use their influence to lead the rest of their industry to follow. With Local Retail advertising, your paper may have the leadership position needed to implement modular on the Local card. If conditions are right, reduced cost to serve, a simpler selling message, promoting effective advertiser behavior and potentially less discounting combine to make the implementation of a modular ad structure a goal worth pursuing.