Pricing for Long-Term Profit and Growth

By Jim Saunders

Price optimization has been the subject of many articles in recent years. Most of those writings have concluded that, in order to optimize prices, you should figure out the demand curve, link it to the cost function, and find the point where marginal revenue equals marginal costs. While this might provide the answer from an economic point of view, it doesn’t measure up from a price-management standpoint.

That’s because it yields a short-term optimization that doesn’t account for the longer-term impact on customers, or for potential competitive reactions. In this article, we will outline the framework for performing price optimization to maximize long-term profit and growth.

Many companies have built a stable core of customers as a base for growing their business. In economic terms, these customers represent a stream of future revenues and profits. There is an entire branch of management knowledge dedicated to understanding these future cash flows and estimating the “Customer Lifetime Value” (CLV) of a segment of customers. The underlying concept is not difficult to understand: today’s customers will make purchases and generate revenues and (hopefully) profits in the future; estimating those likely purchases, and valuing them in today’s dollars is the CLV. The objective in a CLV model is to maximize the Net Present Value (NPV) of these expected future cash flows. The analysis becomes more difficult as we think about all the potential futures we could have with this segment of customers:

- The relationship could deepen, and customers will buy our offerings at an increased rate.

- The relationship could sour, or we could become less relevant to the customer in the future, and our business with them will shrink.

- We may not really have a relationship with this segment of customers at all, and they may dip in and out of our business, and “churn” through our system.

The possibilities are endless, and the intent of this article is not to detail the steps for creating a model for CLV. Rather, we want to look at the impact of pricing on the possible future outcomes, and discuss how the “Price/Volume/Profit Tool,” a vital element for achieving Level 3 of the World-Class Pricing framework (www.pricingsolutions.com), links to this model.

Any business typically has two objectives: to maximize both profit and growth. In fact, these are often expressed as one unified goal: “profitable growth.” But more often than not, one of these objectives is achieved at the expense of the other, rather than both simultaneously.

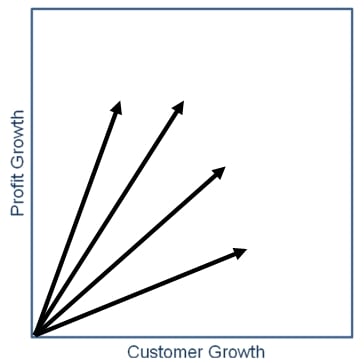

If we were to plot these objectives on a graph, where Customer Growth was on the “x” axis and Profit Growth was on the “y” axis, it would look like Figure 1. The business would follow some trajectory within the box (shown as the arrows inside the box).

Figure 1

But let’s think of those arrows in terms of the available strategies. We had a client recently – a bank – that was trying to maximize the profit from the cash customers would invest in its savings-account product. The simplest way to do this would be to cut the savings rate paid to customers. The bank had a large book of business, and history showed that customers were slow to react by pulling their money out of the savings instrument. Therefore, this would all but guarantee at least two very profitable years, as the bank would save a considerable amount of interest expense on its entire book of business. But what would happen in the future? Even though the profit forecast did not immediately show it, it was clear that business growth would suffer, and ultimately, so would long-term profitability. In terms of our model, the initial move is up the y axis, but you can envision the path turning left and heading down over time.

Here’s another example, this time in the frozen food category. This category, sold through grocery retailers, is heavily promoted. Customers had been trained to wait for a deal. They would enter the category to buy a product on promotion, but in general, showed little loyalty to the brands in it. What was worse, these promotions were only marginally profitable, and required extensive resources to manage them effectively. Looking at our model, the promotions had a huge impact on customer growth (providing some justification to continue this course), but only a slight positive impact on profit. They showed limited ability to move customers solidly into the franchise so that they could be counted on to deliver future profitable sales. In effect, this was a move almost straight along the horizontal axis. Eventually, even loyal customers would catch on and become system beaters, and long-term profitability would begin to fall.

In both cases, a pricing decision had an important impact on the business’s trajectory in Figure 1. The question is: which strategy should the pricing manager pursue?

Our belief is the effectiveness of a pricing strategy has to be measured over the long term, and not solely by its ability to deliver quarterly, or even annual, profit and growth targets.

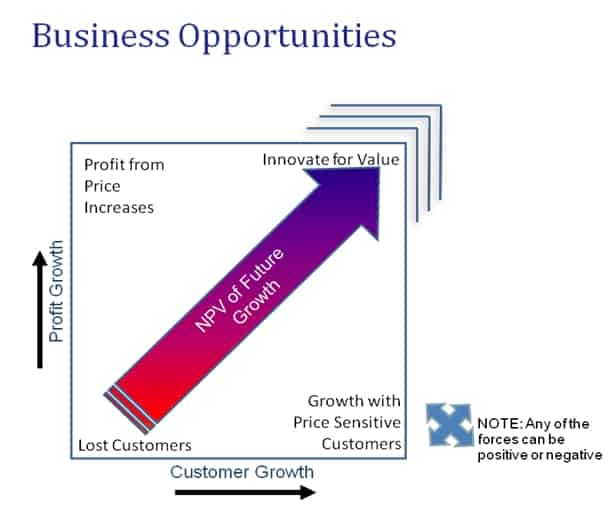

Your business has an available margin pool (the total available margin that customers are prepared to generate in a given segment over the product life cycle). The objective of the pricing strategy is to capture as much of that margin pool as possible. A number of factors might affect that result:

- A price increase – harvests the value from existing customers, but if not supported by a corresponding improvement in customer value (perceived or financial), the active customer base will shrink and the NPV of future cash flows will erode. The exceptions are markets experiencing rapid growth, or inflationary markets.

- Deals and promotions – bring new customers into the franchise and encourage existing customers to buy more. They provide the potential for growth (usually with price-sensitive customers), but if these lower-priced purchasers cannot be fenced off from the full-price-paying customers, or can’t increase the base of profitable customers, profitability will erode.

- Poor customer experiences – represent a risk to the future customer base unless the complaint can be converted into an opportunity to grow the relationship.

- Innovation that delivers value – represents the opportunity to expand the available margin pool. It drives deeper, broader relationships with existing customers, and can draw new, profitable customers into the margin pool.

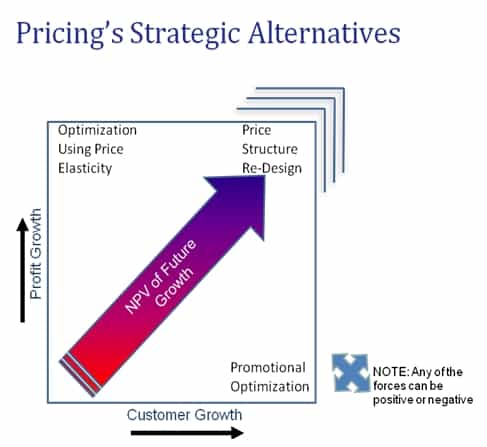

Pricing management plays a critical role in the business’s trajectory into the future. The model presents three basic strategic paths for the pricing manager to follow. Our experience shows that effective pricing managers will choose a path that considers each of the three major trajectories: price optimization of the everyday business through price increases or decreases; optimization of promotions for growth and profit; and changes to the pricing structure.

As part of a strategic approach to price increases (or decreases), pricing managers often invest in research to develop an understanding of price elasticity, including the cross-elasticity of products in the portfolio. Even without changes to the pricing structure, this information enables them to determine a local optimization of profit, and expected volume.

In the case of promotions, the optimization has to consider both the tangible and intangible effects. The pricing manager can analyze transactional data to understand the expected lift and profit, as well as the “stickiness” with customers. Taking a more strategic viewpoint leads the pricing manager to think about potential competitive reaction, and customer expectations that deals are always going to be available.

Ultimately, the optimization of both everyday prices and promotions leads pricing managers to focus on segmentation. More effective segmentation, as well as a pricing structure that responds to the needs of specific segments, provides an opportunity to improve both growth and profit in the long term – the “Holy Grail” of pricing. Figure 3 shows the strategic alternatives.

While many companies in recent years have adopted initiatives to improve pricing management – typical starting points include implementing price increases or more effective management of promotions and other discounts – the real opportunity lies in the ability to segment customers based on their willingness to pay, and introducing a revised pricing structure that caters to the needs and constraints of each. If we return to the example of the bank savings product, the bank had taken a “one-rate-fits-all” approach. However, analysis of the cost structure revealed that high-balance customers were extremely expensive to replace if they were to leave. A change to the bank’s pricing structure allowed it to offer premium savings rates to premium clients. The reduction in lost volume led to a healthy growth in assets, while a reduction in the required acquisition costs improved the bottom line.

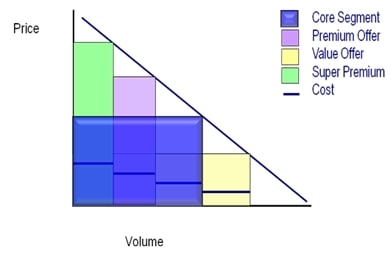

If we think about price structure changes in terms of “willingness to pay,” the opportunity becomes clear. Figure 4 shows a simplified demand curve where we have plotted willingness to pay as a function of different market segments. In the simple case where the company has one offering at one price, the available revenue is represented by the blue rectangle. The revenue “left on the table” is represented by the two triangles (above and to the right of the rectangle). These are the customers who were willing to pay more but were not given that opportunity, and the customers who did not buy because the offer was too expensive, respectively. If, through effective segmentation and price fencing, the company can offer a new price structure, as shown by the addition of the green, purple and yellow rectangles, the revenue opportunity will grow, and the money left on the table will shrink. A pricing manager should structure the offers so that costs to service customers decrease with decreasing willingness to pay – but that’s a topic for another article.

Figure 4 – The effect of price structure on revenue

In this article, we have presented examples and a framework for maximizing long-term profit and growth. Unfortunately, too many pricing managers fail to consider more than one of the trajectories in our profit-growth model. Yet, our work has consistently demonstrated that innovation in pricing structures offers one of the most powerful opportunities for a business to grow and be profitable in the long run.

Jim Saunders, P. Eng., MBA, Leader Pricing Management Practice

Jim Saunders leads the Pricing Management practice at Pricing Solutions. He has helped many clients, both large and small, bring a more disciplined and analytical approach to their pricing. His work has been implemented in industries as diverse as packaged goods, pharmaceuticals, transportation, financial services, and the media.

Jim joined Pricing Solutions after 12 years in management at two major international corporations. As Director of Finance for Nestlé’s confectionery business, he was responsible for pricing. In that capacity, he led the implementation of several price increases, controlled a large discretionary trade spend budget, and improved equitability of pricing and trade programs across a range of trade channels. In his position as Manager of Strategic Planning at Bombardier Aerospace, he was responsible for developing a radically redesigned process for development of new aircraft programs. It is the blend of his background in finance and process management that gives him a unique, practical perspective on pricing.

Jim has helped clients save management time and effort by simplifying pricing processes and eliminating up to 80% of their pricing records’ and the associated complications. He has also enabled them to focus and simplify their offerings, leading one client to more than double its profits. Through transactional analysis, he has helped clients understand the behavior of their customers and develop effective bundles to capture share and increase profit. He has built forecasting models of price, volume, profit, and risk in a wide variety of industries.

To reach Jim at Pricing Solutions please call: (416) 863-0685 ext. 114, or email him at: jsaunders@www.pricingsolutions.com.

About Pricing Solutions

Pricing Solutions Ltd. specializes in four core services: pricing research, pricing management, pricing trainingand advisory services.

Under the leadership of President Paul Hunt, Pricing Solutions has grown exponentially since its inception in 1994. We have offices located in North America and Europe.

Our pricing expertise is based on more than fifteen years of in-depth work on pricing optimization in B2C and B2B markets. We have developed a wide range of proprietary tools, processes and research techniques for studying and analyzing our clients’ problems. The typical payback on an engagement is 10:1. We have been privileged to work with many of the world’s leading companies and are proud of the long-term relationships we have built with them. Many of our clients’ relationships extend back to the inception of the company.

Our philosophy includes the following: the senior managers who sell the work are also the people who do the work, collaboration is at the heart of our approach to completing successful projects and long-term relationships are the key to business success.

To learn more, join the Pricing Solutions Clubthrough LinkedIn.

This article was published in the 2010 Journal of Professional Pricing from the Professional Pricing Society.

Download the article through here