7.5%

Value Increase on BU 1

14X

ROI on BU 2

25X

ROI on BU 3

The Challenge

The private equity firm and the portfolio companies did not have in-house pricing expertise, nor had they identified specific pricing goals, but the high-level goal of the project was to establish a value-added approach to their pricing.

Additional challenges that the firm and its portfolio companies experienced included a(n):

- Increasingly complex pricing environment due to a growing number of SKUs and product options

- Municipal project bids process that drove prices down

- Manual list and discount model

- Lack of internal tools and skills to accurately analyse the high volume of transactions and confidently report on net margins.

Private Equity

Low-interest rates and technological innovations are challenging and disrupting the way private equity firms have traditionally operated. These factors are especially challenging for firms heavily invested in traditional industries. As it becomes increasingly difficult to improve the bottom line, many private equity firms are turning to new, innovative methods of value creation in order to compete in the current business environment.

In this case, the client was a private equity firm with a diverse portfolio of mid-size manufacturing and technology companies as well as a channel mix that included original equipment manufacturers (OEMs), regional distributors and independent representatives. The portfolio companies’ key products were commoditized and included plumbing parts, construction materials, and data services. The private equity firm needed to innovate its value extraction with the goal of increasing the return on investment (ROI) on its portfolio companies. The client partnered with Pricing Solutions to undergo a pricing strategy transformation that realized a sustainable value increase of 7.5%, 10%, and 15% for three portfolio companies..

Building a Solution that Fits

Pricing Solutions conducted a 3-step Pricing Transformation project for this client:

Step One: Discovery & Assessment

During this step of the project the Pricing Solutions team:

- Performed a rapid diagnostic of each portfolio company’s pricing processes

and infrastructure - Conducted internal interviews with Sales, Marketing, Product Management, Finance, Operations and Executive Management teams from each portfolio company

- Scored the client’s pricing processes against existing World Class Pricing benchmarks

Step Two: Analysis & Planning

During this step of the project the Pricing Solutions team:

- Used a workshop approach to coach and educate small teams on pricing analytics and building dashboards in Tableau

- Implemented transactional analyses common to all companies including pricing power analysis, discount dispersion analysis and pricing waterfall methodologies

- Identified primary data fields for pricing decisions.

Step Three: Strategic Recommendations

Next, the Pricing Solutions team made several strategic recommendations based on the discovery, assessment, analysis and planning phases of this project. These included:

- Developing pricing strategies tailored to each portfolio company on:

- Micro-segmentation of customers/products

- Municipal bid segmentation and bid tools

- A subscription playbook.

- Providing the client with an actionable roadmap, tools and training to equip the client with the knowledge and confidence to move forward with strategic pricing decisions.

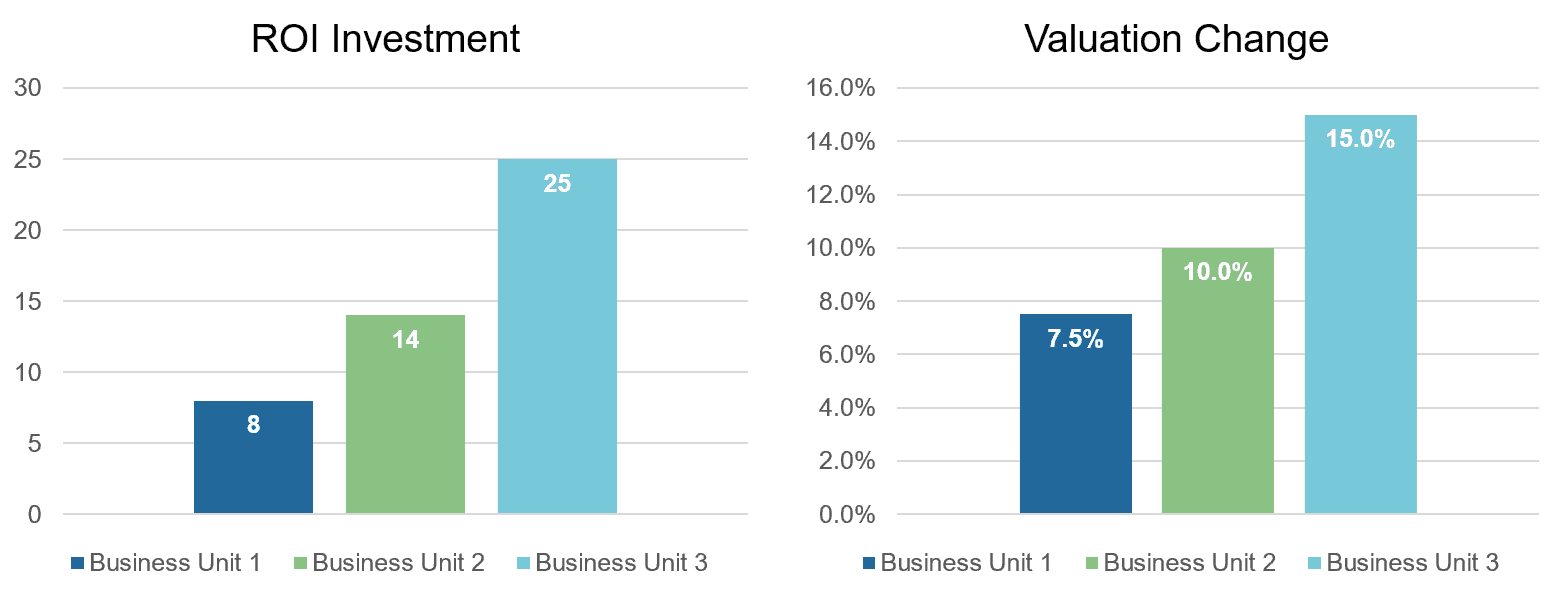

Above: the result of the pricing transformation project on three portfolio companies

The Result?

By the end of the pricing transformation project, the portfolio companies improved their positioning on the World Class Pricing Maturity Levels and transitioned towards a value-based approach to pricing. For the private equity firm, the top line pricing strategy had a highly leveraged effect on the bottom line which delivered a high ROI of 8X, 14X and 25X across the three business units. Lastly, the pricing strategy had an iceberg effect on the company’s portfolio value assessment and generated an estimated increase of 7.5%, 10% and 15% respectively across the three portfolio companies.

The Pricing Solutions Difference

Improving portfolio returns can be a complex endeavor. While private equity managers can use pricing as an effective lever with high EBITDA , private equity firms often don’t have in-house capabilities to launch an effective pricing transformation.

Pricing Solutions combines deep-level expertise in pricing and recognizes the unique challenges that private equity investors face. Our team delivers strategic solutions tailor-made to each portfolio unit to maximize value extraction and improve returns to the bottom line. Pricing Solutions’ ongoing training and strategic roadmap ensured that the client had the confidence and knowledge to effectively implement pricing changes. To learn more about our private equity and venture capital expertise, contact us today.