Pricing your product or service to a new geographic market may seem risky, but conducting research on psychological pricing can ease the challenge significantly. It is a common mistake for growing companies to keep their pricing strategy sedentary as they expand to different markets. The truth is, consumers across different geographical areas perceive prices differently, so the pricing strategy must be responsive to the market perceptions in order to maximise profits.

Price Perceptions Change by Location

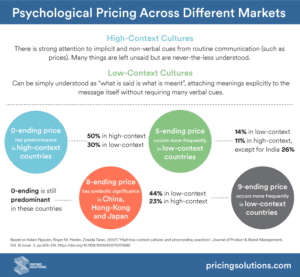

In Roger M. Heelers paper ‘High-Low Context Culture and Pricing-Ending Practice’, he outlines a simplified way to break down international market psychological pricing. The concept revolves around High- and Low- Contexts, and how much a particular culture draws meaning from their context, or just takes numbers at face value.

• In High-Context Cultures, there is strong attention to implicit and non-verbal cues from routine communication (such as prices). Many things are left unsaid but are never-the-less understood.

• In contrast, Low-Context Cultures can be simply understood as “what is said is what is meant”. Verbal cues are not used extensively to communicate.

Heelers selected ten countries/regions from both developed and developing countries, spanning Asia, North America, South America and Europe. Six high-context countries included China, Hong Kong, Japan, India, Brazil and Argentina, and three low-context countries were USA, Australia, and Norway. Italy was also selected as a Western, but the high-context country to provide stronger evidence that it’s the high-low context difference that leads to different price ending practices, instead of Western vs. non-western categorization. To study price perceptions across chosen countries, Heelers collected prices on the web mainly from MSN, Yahoo and AOL shopping portals. Product categories included grocery, gift, handmade crafts, clothing, cosmetics and other general merchandise. An average of 350-650 price points samples was selected in each country for analysis.

Key Findings

Heelers study discovered key interesting differences in psychological pricing across different markets:

• 9-ending occurs more frequently in low-context countries (44% compared to 23% in high context countries).

• 0-ending has predominance in high-context countries (50% compared to 30% in low-context countries).

• The predominance of 0-ending is even supported in China, Hong Kong and Japan where 8-ending has symbolic significance.

• 5-ending occurs more frequently in low-context countries (14% compared to 11% in high-context countries) except for India (26%).

A practical way to see these findings in motion is by going to the Apple online store. The price for the lowest-end 13-inch MacBook Pro in the Japanese store (high-context market) is ¥142,800 vs. $1,299 in the American Store (low-context market). If you browse through Apple’s prices in North America you will see that they almost always end in ‘9’. While at the same time price endings in the Japanese Apple store are mostly even numbers, usually ‘0’.

Psychological Pricing Infographic

Applying Psychological Pricing for Profit

Consumers from high-context countries are less attracted to the illusion of cheapness or small gain created by “just below the round” odd endings. Instead, they are more likely to perceive such a pricing structure as manipulative or a marketing tool to “fool” them. Therefore those markets might link negative feelings to the retailer/manufacturer. Even endings are a “safer” pricing practice in high context countries, such as India, Brazil and China. Accordingly, odd endings should be operated in a ‘realistic’ way that communicates real savings and value that is of significance to consumers.

While psychological pricing is important, it is just one component of the robust pricing research that your business should conduct before entering new markets. In-depth pricing research can provide you with the customer information you need to make informed strategic decisions in the new space. As seen from our experience, strong pricing strategy backed by with data and research brings millions in pricing opportunities within a few months.