The Evergreen, the enormous shipping container that infamously blocked traffic in the Suez Canal for almost a week was earlier this year, but experts say the impact is and will continue to be felt throughout global supply chains.

The traffic jam in the Suez Canal isn’t solely to blame, of course. There’s been a global surge in the cost of raw materials like metal (cobalt, in particular), granite, and even food. Pandemic-related disruptions, increase in demand, intense supply pressures, trade restrictions, tariffs, increasing labour costs, rising import/export costs, and more are wreaking havoc on pricing in the manufacturing sector.

Are there options for pricing or contracting that can protect companies from these sorts of price shocks? In the past, very large companies may have used hedging strategies. The airline industry, for example, notoriously purchased and stored fuel when prices were at their lowest. The problem is enormous volumes are needed to make hedging profitable and in today’s world of just-in-time manufacturing and delivery, it doesn’t make sense for most industries.

So, as raw material costs increase by as much as 10% and lead times are close to doubling,

manufacturing companies must respond with precise, strategic pricing. We provide the solutions to successfully maneuver such cost shocks, especially when it’s unclear whether today’s raw material increases will be sustained or are simply short-term spikes.

Pricing – You Have Options

In competitive markets where everyone is experiencing the same cost shocks on raw materials, some companies are fearful of responding with price increases. The good news is that there are options. Before going directly to a price change, consider other options that will help you recoup costs by varying the value, not the price:

Adjust the composition of the product

One way that companies dealt with steel tariffs was to remove or reduce the amount of steel used in the products that were manufactured. The ability to adjust the composition of a product will depend on the raw material in question, and whether there is a more affordable alternative.

Change packaging

Some food manufacturers have absorbed surges in price by changing their packaging. Take a product like ketchup or mustard. The price may be the same per bottle, but the volume contained in each bottle could be reduced.

Alter the supply chain

In some sectors, supplier lead time has gone from 20 to 40 days primarily due to capacity constraints felt by suppliers of materials like silicone. This is creating a ripple effect along the supply chain. If raw material price increases or delays are due solely to supply chain disruptions, then it may be possible to find a new supplier or new product that is less vulnerable.

Examine your services

In every manufacturing company, there are services that you can adjust to reduce your Cost-to-Serve and capture back margins. Timing, delivery, and freight are areas worth examining. For example, when dealing with price shocks on raw materials you could move the order window to 60 days out. Those customers who work within this order window have reduced your Cost-to-Serve and therefore, receive the existing price. Those who have greater urgency may be willing to pay slightly more for delivery assurance or at least now can have transparency into the trade-off decision.

Narrow Discounting Strategically with Customers

Most businesses have a long list of customers contributing relatively little to top-line revenue and, even worse, buying low-margin products. The administration and fulfillment cost of these orders often wipes out any remaining profit. Further narrowing or eliminating discounts for these customers will drive up profitability and reduce complexity.

Add a surcharge

Surcharges can help you cover costs, and while they’re not likely to increase your profits, they can help you maintain revenue during times of significant commodity price fluctuations. Many companies have successfully added on a surcharge to help deal with tariffs. This solution works when the price increase is expected to be temporary. When the added cost is removed, then the surcharge disappears.

Another benefit of a surcharge is that it can be easier to position to customers (some will be more able to absorb the cost of the surcharge). A surcharge can reduce the time for your sales team, too.

It also helps if your competitors respond to commodity price fluctuations with a surcharge – it can become a tactic that’s accepted across the industry which will reduce customer resistance.

One thing to consider, though is that most dealers and distributors won’t accept surcharges. They recognize that the cost is being passed to them and so in such cases, building the surcharge into the price may be a better option.

Increase prices carefully

When you run out of ways to absorb the surge in costs, you may have to look at targeted price increases. Before you do, consider how much time it will take to implement the price increase. In some industries, there is a time lag between when costs go up and when the company can recover revenue from that price increase.

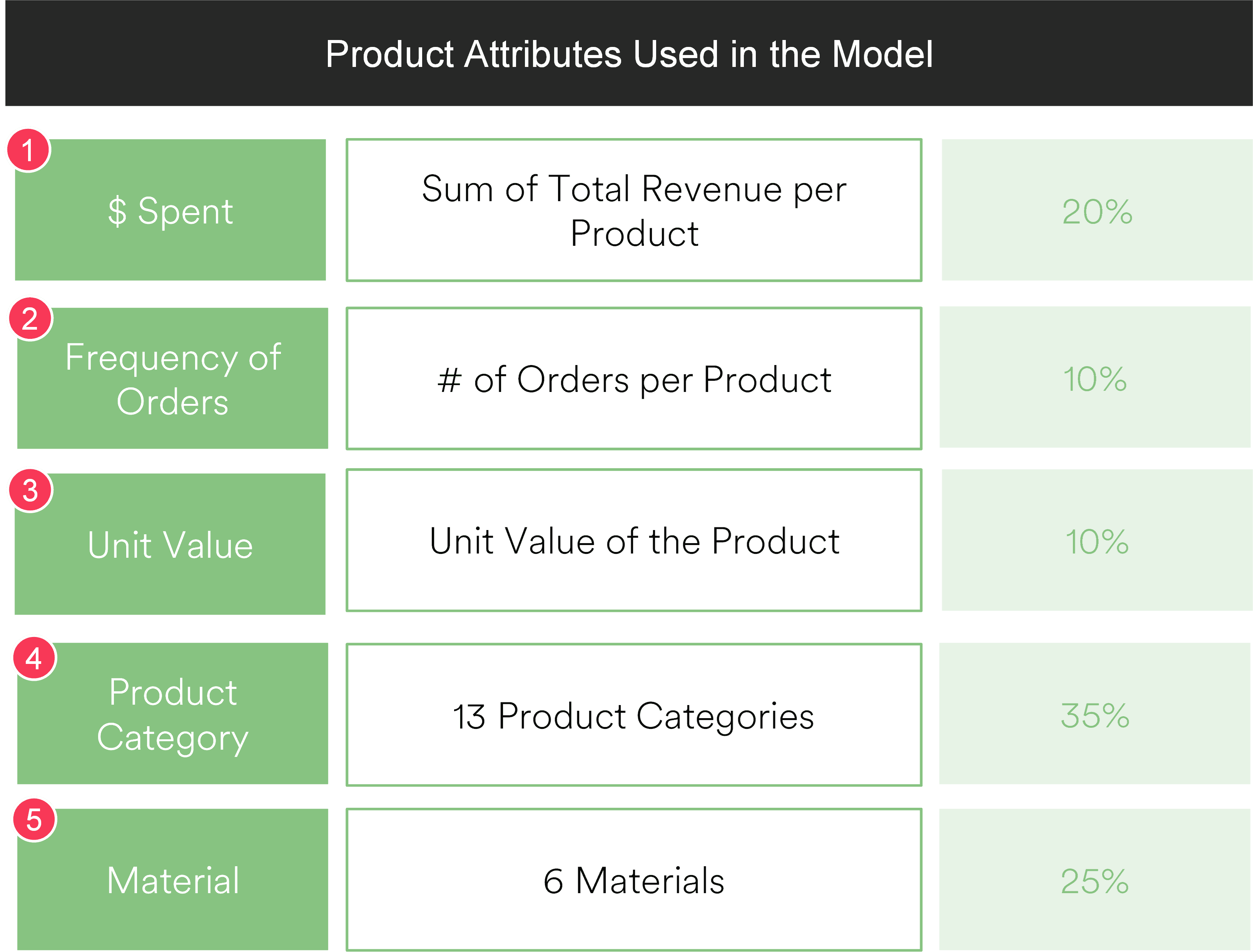

It’s also important to consider whether it’s more advantageous to do across-the-board price increases or to increase some products over others. Targeted price increases are more effective at price capture than across-the-board increases when you have not addressed Cost-to-Serve and discounting rules. Unfortunately, most companies don’t have a product portfolio price structure based on pricing power. They tend to instead use a cost-plus model in which one product is priced higher than another. However, there are some common attributes like frequency of orders and the unit value that companies can use to analyze pricing power – these product attributes are very industry and company-specific. Determining your pricing power will allow you to strategically target price changes with greater confidence.

Example

Also, determine whether any price increases will be permanent or temporary (like a surcharge). Sometimes, prices won’t come back down, in which case there is an advantage of changing the pricing on a product by product basis. Companies like Starbucks tend to have a strategy in place that governs which products will increase. Those companies would be wise to keep that structure in place when considering pricing.

Find Creative Solutions

How do you know that a 10% across-the-board pricing increase will provide a return? When financial analysts do modeling, they wait until the results come back to know the true business impact, answers which could be six to eight months out. Price changes have a lag that will delay the full impact on performance, and if you do price changes first then the bottom-line impact will be less than anticipated. There is a smarter way to address cost shocks:

- Change the value without changing the price

- Address Cost-to-Serve differences

- Narrow discounting on the least strategic customers and transactions

- Increase prices by targeting attributes that structure pricing power

- If you still want to do a price increase across the board, look for opportunities within the portfolio to go even higher.

Most of these actions can be done, at some level, in quick succession to increase the probability that you’ll maximize your return. Rather than throwing a price out there and relying on modeling, opt for a combination of the creative solutions mentioned above with a goal of improving EBITA. Of course, we encourage you to reach out to the team at Pricing Solutions if you’re looking for expert advice on pricing in the wake of commodity cost shocks.