By Shveta Kanetkar, Strategy Consultant at Pricing Solutions

Tariffs are a hot topic in industrial markets. Companies are trying to manage the 25% tariffs on steel and 10% tariffs on aluminum, going into effect later this year, while product exceptions are still being determined. A recent FT article outlines some of the challenges faced by companies dealing with tariffs. Many organizations are looking to finance and pricing teams to help assess the situation, alleviate internal uncertainty and provide realistic options to maintain profitability. To help pricing professionals grapple with some of the complexities of tariffs we’ve listed a 3-Step process to help guide your price adjustment decisions and strategy.

Step 1: Understand the Impact of Tariffs

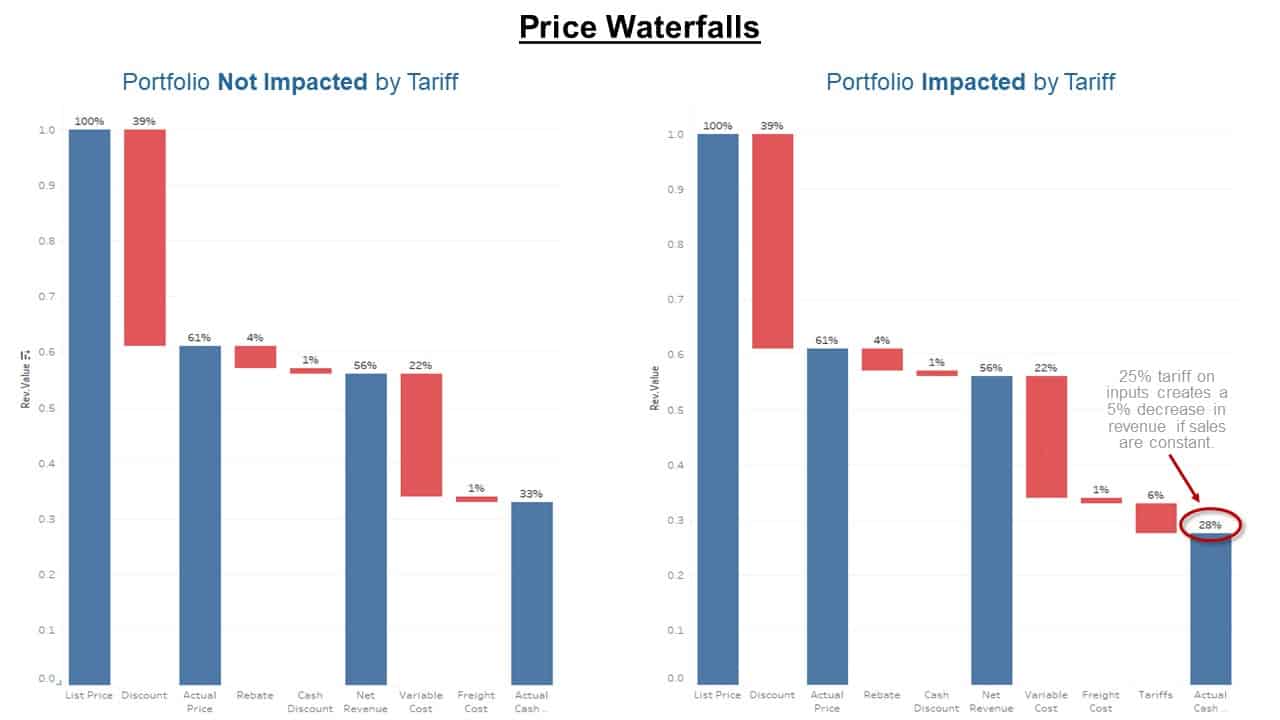

Successful manufactures constantly manage their capacity and production mix to optimize operational efficiencies and profit at the portfolio level. However, as tariffs disproportionally impact different products it becomes critical to have a more granular view of how changes in cost impact overall profitability. A classic tool in the pricing toolkit is the price waterfall analysis. Visualizing the impact of tariffs on your waterfall could help guide decisions related to price changes and production allocation.

Below is an example of a price waterfall that looks at the portfolio impacted by tariffs and the portfolio that is not impacted by tariffs. In our example, we measured ‘actual cash received’ or pocket price vs. list price to understand the effect of tariffs. On the waterfall charts below, we can see a pocket price of 33% on the portfolio that was not impacted by tariffs vs. 28% on the portfolio that was impacted by tariffs. We can also visualize the various levers that could be pulled to mitigate the impact of tariffs. We can’t stress enough the importance of having clear visibility into all the options at your disposal to make informed business decisions.

Step 2: Measure the Impact of Cost Changes

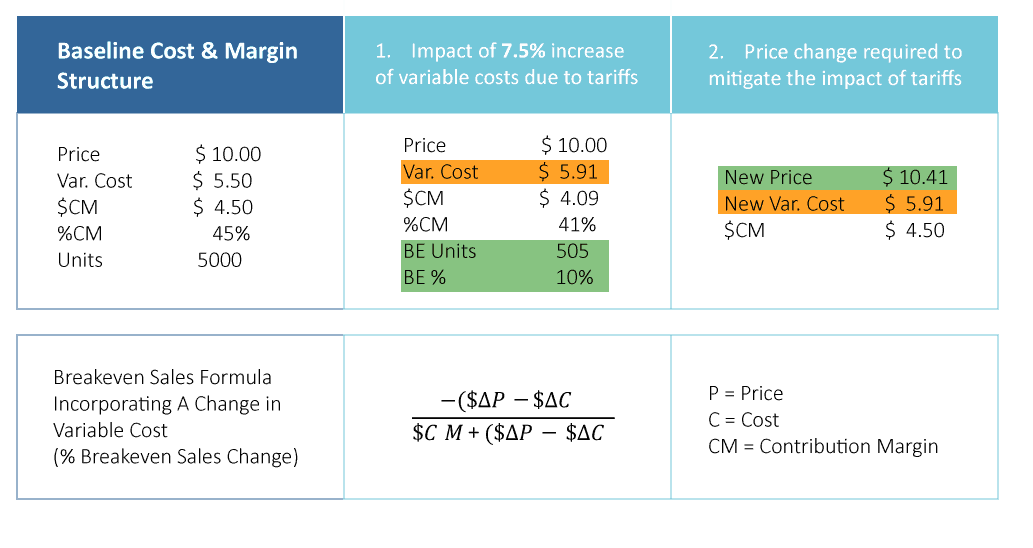

When costs are changing it is important to understand how they impact profitability. A great tool in your arsenal is the financial breakeven analysis. The financial breakeven analysis allows you to model what could happen to volume, price, and margin as your cost structure changes. Below we illustrate how cost and price changes could be analyzed to mitigate the impact of tariffs.

- Scenario 1: Maintaining Profitability Through Increased Sales

Using breakeven analysis, we can see that a tariff that increases your variable costs by 7.5% would require a 10% increase in sales volume to maintain current levels of profitability based on the margin structure of the business.

- Scenario 2: Maintaining Profitability Through Price Adjustment

The breakeven analysis also shows us that if volumes are expected to remain flat then the cost of the tariff would need to be passed onto your customers through a 4% price increase to maintain current levels of profitability.

Step 3: Select the Optimal Option for Mitigating the Impact of Tariffs

Knowing how to structure and execute price increases requires a targeted approach with a well-planned communication strategy to ensure success. When it comes to tariffs you will likely have several ways to pass along the price increase. Possible options include:

- Develop Tariff Surcharges – surcharges are flexible and a can be a powerful tool for executing temporary price adjustments.

- Tighten Discount Policy – establish new or enforce existing pricing guardrails to limit discounting, especially on products that are directly impacted by tariffs.

- Adjust List Price – although more of a permanent fix, list price adjustment send a signal to your customers and the market that you are confident of your value proposition and intend to protect the integrity of the business.

Once you select the best approach for your business it is time to get your sales team on board and fully trained on how to communicate and execute your tariff strategy.

Instead of looking at tariffs as a burden to the business we encourage you to view it as an opportunity to evaluate your cost structure and explore opportunities to tighten up your pricing process. Changes in market dynamics also allow you to connect with customers and reinforce the value you deliver. Making price adjustments are never easy but with internal commitment and organizational alignment, your company will continue to succeed through these uncertain times.