By: Savannah Dixon, Pricing Analyst, Iris Pricing Solutions

In the constantly changing world of business, discovering the ideal pricing strategy is critical to unlocking untapped revenue potential. It’s a puzzle that can make or break your success, and the choices can be daunting. In this article, we explore four fundamental strategies: Cost-Plus Pricing, Value-Based Pricing, Competitive Pricing, and Dynamic Pricing. Each approach brings its unique set of benefits and challenges, and understanding how they align with your business objectives is the key to revenue growth.

Cost-Plus pricing

What is it?

Cost-Plus pricing is the simplest pricing strategy. It involves calculating the overall cost of a product or service, and then adding a markup or profit margin. That way you can quickly determine the selling price, as below:

Selling Price = Total Cost + (Markup x Total Cost)

Or

Selling Price = Total Cost / (1 – Margin %)

When might this pricing strategy be suitable?

Cost-Plus pricing can only be used if the cost of goods sold is known. The total cost includes both fixed and variable costs. It is a useful pricing strategy to ensure that you are covering those costs and turning a profit. Cost-Plus pricing is most suitable when there is limited product differentiation, for example when selling commodities, or when customers are only focused on price.

What are the limitations of this pricing strategy?

Cost-based pricing is clearly quite rudimentary. It can be very useful to have a simple strategy, but you won’t always know if profit is being maximized.

How do you work out what margin you should be aiming for on each product? Too high a margin and you will be pricing yourself out of the market, pricing above similar competitors. Too low and you could be underestimating how much consumers value the product and are therefore willing to pay, leaving profit on the table. Taken out of context, a Cost-Plus Pricing Strategy could be very harmful. It is for this reason that we don’t usually recommend Cost-Plus Pricing be used in isolation, but with some element of competitive analysis or value-based pricing added on top.

Secondly, it is not always easy to work out those costs, which can fluctuate month on month, and it may not be obvious how to attribute overheads to the various products. In some cases, the incremental cost of selling another unit might be negligible, such as is often the case with SaaS companies. In such cases, a cost-based strategy may be better avoided.

How can we help?

Our analytics team can help you identify quick-win opportunities through price leakages or under-priced products in your data. This can help you refine and level up your strategy where prices were previously set on an ad-hoc basis, without adding too much complexity.

Cost-Place Case Study – Click here

Competitive Pricing

What is it?

Competitive Pricing involves assessing pricing relative to competitors and setting prices based on that. Perhaps you want to convey the message that your product is better than your competitors and therefore set a higher price (price signaling). More often when we think about Competitive Pricing, we think about charging in line or less than competitors.

An example of charging the same as competitors in supermarkets in the UK is the “Aldi Price Match”, where for certain staples such as milk, bread, and certain fruit and vegetables, the supermarkets all charge the same price, baselined at the Aldi price (since that is perceived to be the cheapest.)

Competitive Pricing can help to ensure that market share is maximized, by ensuring price-sensitive customers choose your product over competitors. However, this won’t necessarily mean profit is maximized.

When might this pricing strategy be suitable?

Competitive Pricing is suitable for a product or service with many substitutes, where demand is fairly elastic, and where the product or service does not differentiate itself from competitors (otherwise Value-Based Pricing should be used). It is also most viable for businesses where the search costs associated with obtaining competitor prices are low, typically because these are publicly available (e.g. B2C, retail, and eCommerce).

What are the limitations of this pricing strategy?

Competitive Pricing does not capture the unique value of a product or service, and so may leave profit on the table. If it is not balanced against costs, it can also lead to loss-making sales as prices or costs change.

A risk of competitive pricing is that it can sometimes lead to a price war, where the various players in the market take turns to set the lowest price in a vicious spiral, driving the price down.

How can we help?

One way we can help with Competitive Pricing is by data scraping in order to get the competitive intelligence you need to set prices. We can help you to track competitor price information for different products over time.

Competitive Pricing Case Study – Click here

Value-Based Pricing

Value-based pricing is a strategy that involves setting prices based on how much value consumers believe they receive from a product or service, and therefore how much they are willing to pay. Perceived value is a function of both the actual value a product or service delivers and the communicated value, which may be totally distinct from one another.

When might this pricing strategy be suitable?

Typically, when people think about Value-Based Pricing they think of pricing for luxury goods. While luxury goods do benefit from Value-Based Pricing, a Value-Based Pricing model can be applied to any product that differentiates itself from competitors or offers some unique value.

What are the limitations of this pricing strategy?

The challenge for Value-Based pricing is in determining how much customers value what you offer, and then quantifying this value. It’s not the same for every customer and it might change over time.

Here are two techniques to help you adopt value-based pricing. While you can’t know exactly how much your customers will value what you’re selling to them, these techniques can help you estimate value, and therefore estimate willingness to pay.

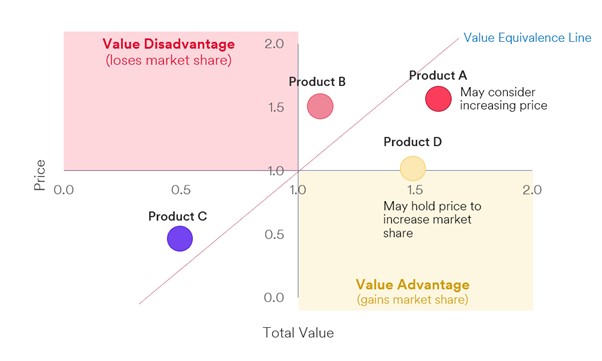

1. Perceived Value Mapping

Perceived Value Mapping is the process of visualizing the trade-off between value delivered and price paid for a given market, as seen through the eyes of your customers.

You calculate the perceived value by looking at all the different factors your consumers might care about when considering whether to purchase a product (“value drivers”), how much they care about those factors, and how well each solution performs in addressing these. Perceived price is simply how much your product is perceived to cost relative to competitors.

The perceived value map gives a good sense of where you stand relative to competitors in terms of how much value you deliver for what price. It can help to inform discussions around pricing and price strategy, as well as illustrate challenges with value perception and communication.

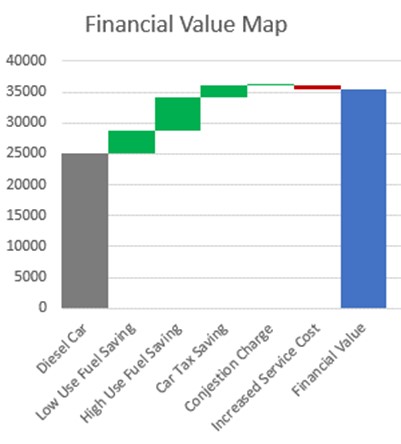

2. Financial Value Mapping

In Financial Value Mapping you are calculating the different ways your solution creates a financial benefit for the customer, either by reducing their costs or increasing their revenues.

You start with a baseline product, which is usually the next-best alternative to the target product, and work out how much financial value is added and how any additional costs are subtracted incrementally.

For example, in the car market, an electric car in comparison to a fuel-efficient diesel car may deliver £x of value in diesel savings, £y in road tax savings, and £z in terms of additional savings (e.g. the congestion charge, for a person who drives in Central London).

By documenting and quantifying these benefits, Financial Value Mapping can help to inform discussions around pricing and pricing strategy, as well as provide the foundations for a value-based sales strategy.

How can we help?

Value-Based Pricing techniques rely heavily on putting yourself in the shoes of a customer and evaluating the value of your solution through their eyes. One way of doing this is through primary research. By talking directly to customers, we can better understand key drivers of value and willingness to pay, rather than relying on internal perceptions of value. We then analyze the results and provide a set of recommendations.

Contact: Speak to our research team here

Alternatively, by utilizing analytics, we can help you segment your customers and products by various characteristics/attributes. In doing so, you can identify those groups who value your products more and therefore are willing to pay more and translate this into your prices.

Contact: Speak to our analytics team here

Case Studies – Click here for Research. Click here for Analytics.

Dynamic Pricing

What is it?

Dynamic Pricing is the practice of regularly adjusting prices based on changing market conditions, demand, or other factors. Where demand is expected to rise, for example, due to seasonality, price is raised.

When might this pricing strategy be suitable?

One example of where Dynamic Pricing is very powerful is in the travel industry. For example, airlines employ dynamic pricing strategies, where prices are adjusted based on the time of travel and whether this is peak or off-peak, booking trends (e.g., more flights are booked on the weekends), and availability.

What are the limitations of this pricing strategy?

Aside from being more complicated to implement than some of the previously discussed strategies, there may be backlash from those customers paying higher prices for the same product if it is not perceived as fair. This may lead to negative feedback and complaints.

How can we help?

Pricing Solutions can help with every step of the implementation of your Dynamic Pricing model, from design to scaling and testing, to implementation and monitoring.

Dynamic Pricing Case Study – Click here