When it comes to retail pricing structure there’s a lot of variables to take into consideration. Retailers in large chains, especially in restaurants often don’t have control over prices and can’t necessarily enforce pricing changes from store to store. That’s why store tiering is so critical to retail operators.

Despite its benefits, store tiering is a pricing struture that’s sometimes overlooked either because there’s uncertainty about how to implement and manage it, or because of the upfront analysis and continued effort involved in executing it effectively.

Line Pricing vs Store Tiering – What’s the Difference?

Line pricing can be summarized as “one item, one price”. It is very often observed in multi-location businesses (think restaurants, retailers but also B2B distributors with a network of local branches). When such businesses have a centralized pricing organization, it is very common for them to use line pricing and simply apply the same price to the same item across all stores.

Line pricing is not without advantages. It is very simple to implement (some may argue it’s even too simplistic) and provides a great deal of control over its prices to the organization. Very often, it is also seen as “fair” to the customer: no matter where you shop, you will pay the same price for the same item.

Store tiering takes a different, more value-based approach. Its principle is also very simple: some stores can sustain higher price points than others (for the same items) and if the business does not take advantage of that opportunity, it simply leaves money on the table.

Some opportunities are obvious. For instance, New York City’s Times Square, with its 50 million tourists per year, is well-known for being more expensive than the rest of the city, not to mention the rest of the country. But beyond such unique, prime locations, how does one go about setting up a store tiering framework that maximizes economic value for the business and its customers?

Finding the Right Tiering Structure

Once the value of store tiering has been established, usually comes the most difficult question:

How do we figure out the right tiering structure?

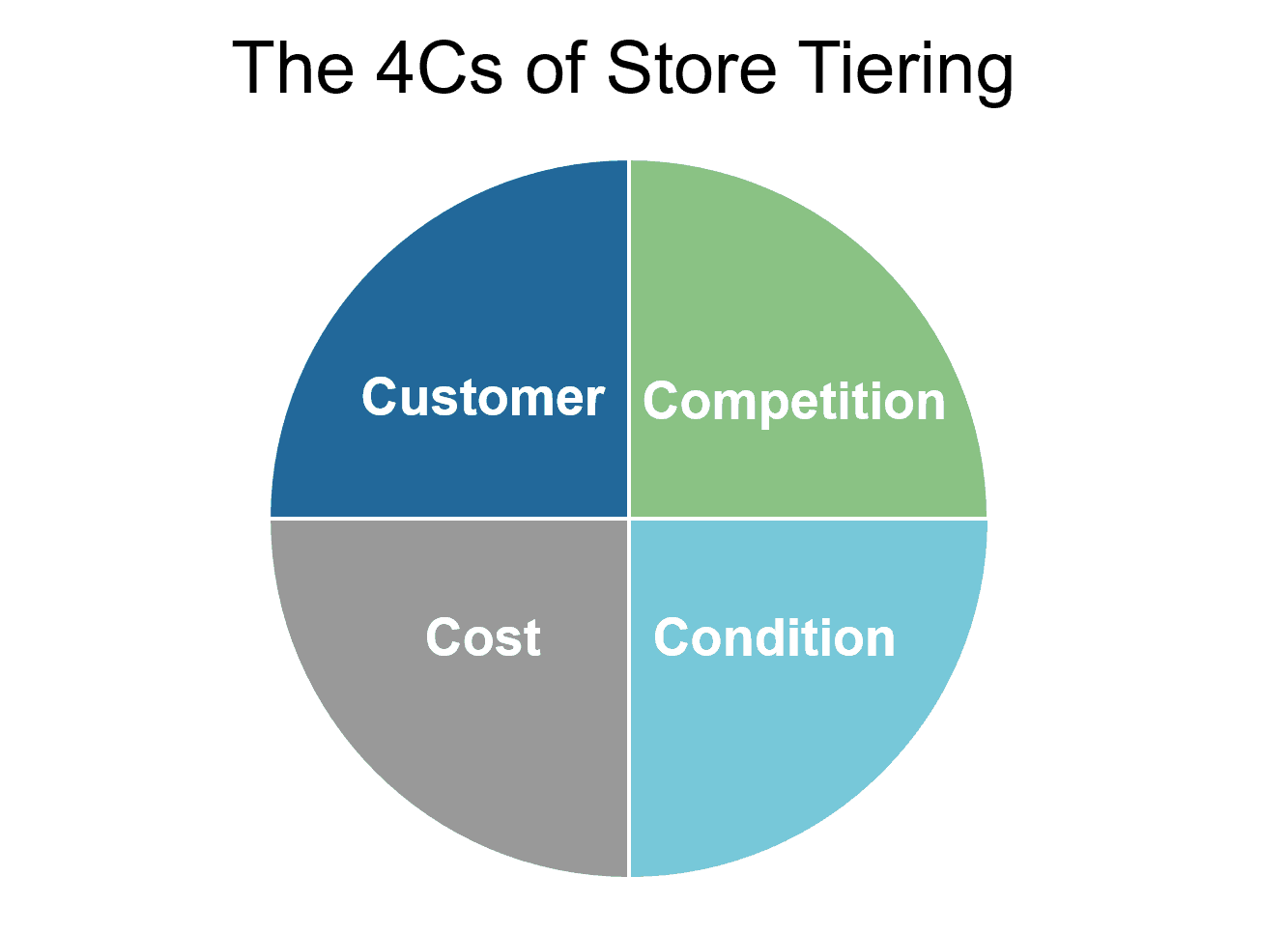

There are various ways to go about it, but they all come down to a simpler question: what are the components of our offer that could drive prices up (or down)? Based on our experience in the industry, we have developed an analytical framework that boils it down to four main components: Customers, Competition, Costs, Conditions. We call it the 4Cs.

The 4Cs allow one to define its store tiers based on hard data while allowing the business to also add its own inputs. Each “C” is measured by objective and quantifiable metrics. For instance, “Competition” can be measured by the average price of nearby competitors or simply by the number of competitors within a certain distance. The relative importance of each “C” in the final score is typically where the business inputs come into play: businesses very sensitive to competition will give more weight to that “C”; businesses trying to grow might give more weight to “Customer”.

As a result of the 4Cs analysis, each store gets a score reflective of its ability to sustain a higher price point than other stores.

The next question one may ask is: how do we know how many tiers we need?

Here, we typically advocate for a mix of business priorities, trends and common sense. The number of tiers should, of course, be correlated to the number of stores. A good rule of thumb is that each tier should have 50-100 stores. Single-store tiers should be avoided as much as possible, unless under exceptional conditions (e.g. our Times Square example above).

Above: an example of a store tiering map

Implementing Store Tiering

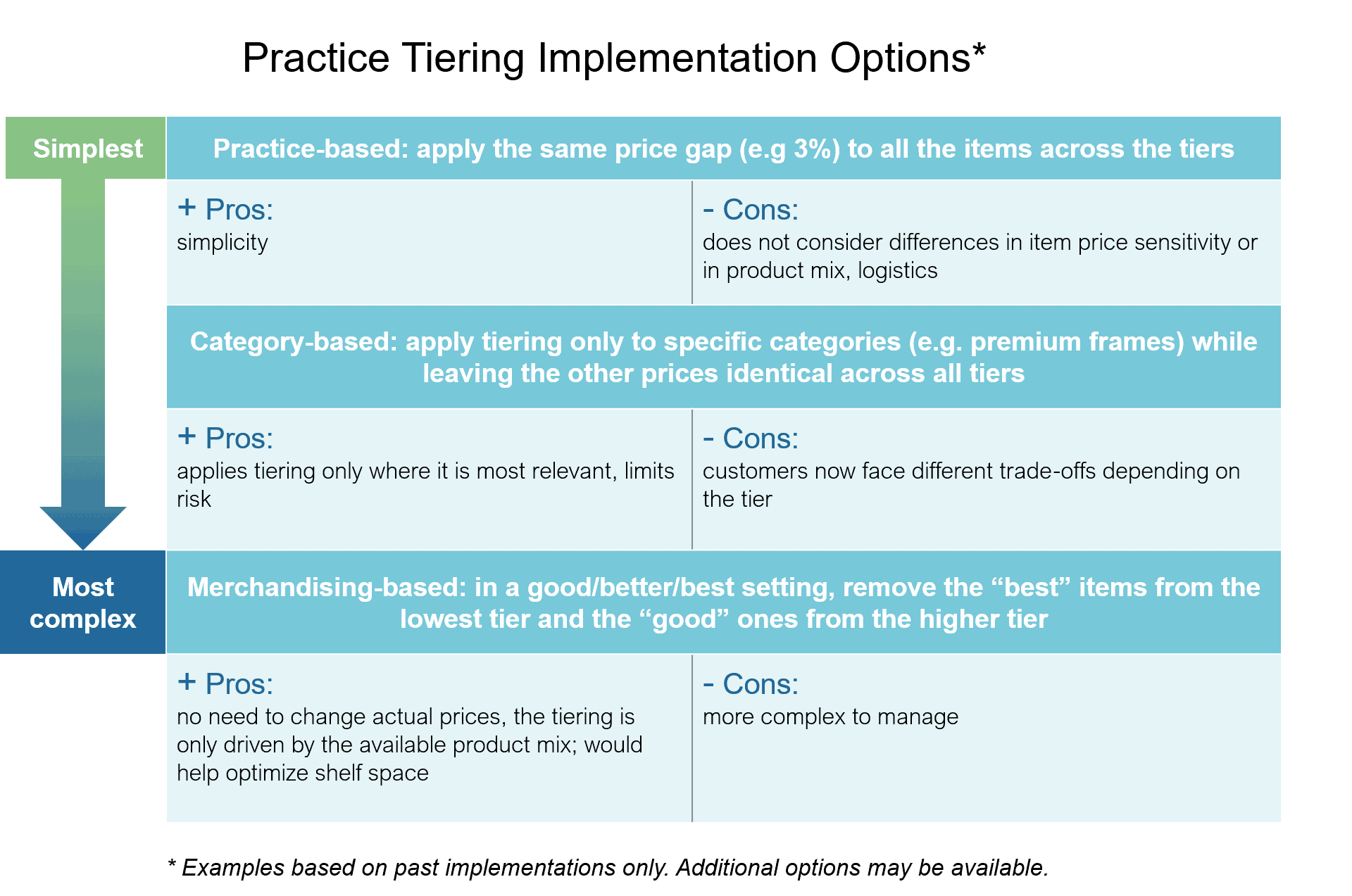

The Times Square example above is an example of store tiering, which is a pricing strategy that segments stores into tiers and then applies the same pricing gap across all tiers. For example, product A could always be 5% more in store one versus store two. This type of pricing can also be done by product or by product category. For example, glasses frames may be 5% more in store one than in store two, but lenses are the same price at all store locations.

Three-Tier Store Model

Under Armour is a real-life example of a three-tier retail store model. Susie McCabe, SVP of Global Retail at Under Armour told MarketRealist that the company has tiered stores depending on their size, impact, and premiumization tilt.

According to McCabe, their tier one stores are “located in major cities like New York, London, and Shanghai, these flagship stores will be sized over 20,000 square feet in North America and over 12,000 square feet internationally. Tier two stores are smaller but operationally efficient and financially self sufficient…Tier three stores will consist of Factory House stores which will cater to more value-oriented customers.”

Under Armour’s approach is typical of a store tiering pricing system. Another common way to manage tiers is by not offering every item in every location (to do this, products must be labeled internally as “best, better and good,” to help determine which products to offer at each tier).

Here is a breakdown of the three most effective options for store tiering implementation:

Generally, a tier one store will be able to sustain higher prices, so it makes sense to offer the best and better products only. These products are sold at a higher price point because the store is premium and offers higher priced best items.

At tier two stores it is typically more difficult to get the best price for the best product, so these tiers also offer lower priced good and better products. Tier three stores offer only “good” and “better products,” and don’t offer the “best” products at all.

Ultimately, the benefits of using tiering pricing structure over line pricing are worth the effort. With the help of the store tiering tool, one of our clients was able to identify an opportunity of +8.3% in annual revenue.

If you are ready to make the leap from line price to price tiering, contact our team for specialist pricing advice to maximize profits and pricing efficiency within your organization./fusion_highlight]