COVID-19 has impacted business across most industries, causing a variety of new pricing challenges and questions. Companies are focusing on pricing now more than ever, and indeed pricing is a powerful tool that can help companies face and resolve the challenges they’re experiencing. When implemented strategically, pricing can generate a bottom-line improvement while also protecting companies from poor pricing decisions, that will cause long-term negative effects. This article will examine the common challenges and potential pricing solutions that companies can use to navigate the COVID-19 crisis.

The Power of 1 %

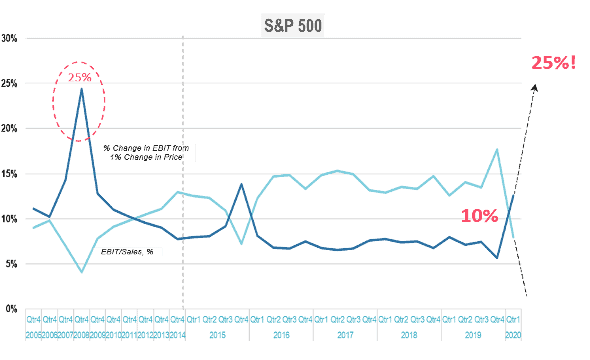

When looking at pricing during a crisis, it’s valuable to talk about the power of 1%. Consider the profit margin for an S&P 500 over time. In the chart below, the light blue line represents the typical margin for this S&P 500 average company which is between 8% and 12%. This 8% to 12% is the value of a 1% improvement in pricing on the bottom line and is represented by the dark blue line.

As you can see in this chart, the value of 1% is somewhere between 8% to 9%, which is typical for most S&P 500 companies. During the 2008 financial crisis, the average profit margin dropped to 4%, which means that a 1% improvement was worth a 25% improvement in the bottom line

So, we know that historically the value of 1% increases substantially as profit margins decline during a crisis. As you can see on the right-hand side of this chart the pandemic hit in the first quarter, and during this time, we already see the profit margins starting to crash. We expect that decline to continue into the fourth quarter and potentially even into 2021. The value of a 1% improvement in pricing during these times is going to accelerate for most organizations. Making the 1% improvement in pricing is really valuable for most companies during normal times, during a crisis when profit margins are really under pressure, this bottom-line improvement becomes substantially more important. We look more closely at the power of 1% across different industries in the next article.

3 Common Pricing Issues Emerging from the COVID-19 Crisis

Based on the conversations we have had with our clients and pricing executives; the Pricing Solutions team has identified three common pricing issues that have emerged during this crisis:

1. Dramatic Changes in Demand

Decreasing or vanishing demand

The number of customers making purchases is changing in a dramatic way. The first change in demand we’re seeing is around diminishing or vanishing demand as with in-restaurant dining, travel, and elective healthcare procedures. There’s no amount of price changes or promotions that can change the decreasing or vanishing demand in these industries. This is a scenario where there’s not a lot that can be done from a pricing perspective, because these services have been basically regulated out in most parts of the world. So pricing isn’t a factor and can’t be a lever in terms of helping with these challenges.

Increasing or spiking demand

On the other hand, there are some industries that are experiencing an increase or a spike in demand. Take our clients in the B2B telecom space, for example. Now that so many businesses are implementing work from home policies, many of these companies are looking to increase their bandwidth to better support their employees who are working remotely. For companies like these, it’s important to protect both profit margins and the brand itself.

Many pricing executives have spent their careers ensuring that the sales force protects margins. Now, these same executives are navigating a change in perspective – ensuring sales teams increase prices enough to profit without being viewed as taking advantage of their customers.

An increase in demand can raise other challenges. For example, companies involved in manufacturing for pharmaceuticals are looking to ramp up production to meet COVID-19 demands. In some cases, this may mean expanding facilities, which leads to important pricing questions, including:

- How to price the new capacity as it clearly is high value?

- To ensure an appropriate ROI on the new capacity, how long should you plan on the demand for these products to last?

These are really important pricing questions that support the business objective of expansion. The decisions will impact the success of the company. Alternatively, those companies that do not price properly will put their long-term viability at risk.

Mixed results

We’ve also seen a common challenge around companies that have an increase in one of their offerings, and a decrease in another offering. In most cases, the company is focused on one or the other without ever looking at their pricing comprehensively. In this case it’s important to treat these offerings differently and recognize where it’s possible to influence results and where it’s not. This analysis will help ensure that the right pricing levers are being pulled and the right pricing strategies are developed so that the company can optimize short term results, while also ensuring that the new pricing policies that are established will not cause long-term harm.

Restaurants serve as a good example. “In-restaurant” dining has all but dried up. However, the good news is that this decline has been offset by “pick-up” and “delivery” meals. Of course, competition is high with other restaurants also looking to establish their share in this space.

One of our restaurant clients, had two goals that they were looking to optimize as part of their pricing strategy. They wanted to increase the frequency of visits from customers and also increase the total spend for each visit.

The solution was two-fold. First, they added a “daily special” to their core menu, which they priced at a premium…encouraging their customers to return to “check out their daily item.” Secondly, they created “family meals” for four. With the family meals they took a single meal they could make efficiently and cost-effectively and they offered this meal at a discount, but gained a cost advantage by choosing a meal that allowed them to offer items in larger quantities, without having to plate everything or provide separate packages for each item. The result was that a family of four could eat for a very attractive price. This restaurant client married the meal with the addition of wine and drink options as a cost add-on. As a result of these changes, they’ve been successful in increasing the number of customer visits, while also instilling loyalty and increasing the dollar amount spent per visit.

2. Cost Spikes

spikes are things that impact your margins and potentially your ability to stay in business. These cost spikes often trigger an internal request to consider a price change. It’s important for pricers to be mindful, observant and to ask questions around cost spikes before initiating a price increase. Here are a few of some common cost spikes we’re seeing right now:

Supply chain (especially overseas)

In many cases, businesses are starting to see the cost of raw materials start to increase, especially if those materials come from overseas (particularly Asia, given the disruptions to supply chains experienced there).

Transportation

Many businesses are impacted by air freight or air transport, given the number of airplanes on the commercial side that have been grounded. These commercial flights were actually fairly important in the transport and supply chain fulfillment of companies. The fact that a lot of these planes have been mothballed in the short term, has caused capacity to spike in regard to supply, delivery and fulfillment. The question then is how to factor these spikes into pricing decisions.

Foreign Exchange (FX)

The companies that are manufacturing in the US and shipping globally are starting to see costs go up in local currencies in Europe, the UK and Asia. The question is whether to reduce the US dollar to keep prices constant in those global markets, or to raise those global prices and potentially impact the ability to be successful.

Regulatory Requirements

Regulatory requirements have impacted a number of industries, and the question is how those industries will be impacted by new regulations moving forward. For example, how will a restaurant manage new regulations allowing in-dining options, but only when patrons sit at least one table apart? At best, these restaurants will perhaps operate at one third of their original capacity. How will these restaurants survive at one third capacity going forward…especially as winter sets in and patio dining becomes less feasible?

The same challenge is being felt in the manufacturing industry, where plants have to maintain social distancing. Doing so can cause some plants to have to shut down a line so that they can meet those regulatory requirements. All these scenarios impact the cost structure of the business.

New government regulations have required many companies to clean and sanitize their on-site facilities more frequently. The increased costs negatively impact margins in such a way that some companies are now losing money on each transaction based on their historical price structure.

The belief is that this will be a temporary regulatory requirement rather than a long-term structural change, so in those cases, the team at Pricing Solutions recommends considering adding a “Covid-19 Fee”, to offset the temporary cost involved in delivering the increased value to the customer. Considering that these companies are incurring a cost that is valuable to their customers, they should be compensated. This fee allows companies to offset their profit losses from this new regulatory requirement and the fee structure (which is essentially the same as a price change but is optically different) ensures customers understand the reason for the price change. Most customers will resist this temporary increase less if they feel it is fair considering that the increased value of more frequent sanitation reduces the likelihood of an outbreak.

Labor Cost Increases

Labor cost increases are another challenge, and we’ve seen this a lot particularly in North America where there is a COVID-19 subsidy being paid to individuals who are unemployed. In many cases, especially with the lower skilled labor force, the subsidy causes them to earn more income while unemployed than when they worked. This imbalance impacts companies looking to continue or return to business, as their ability to attract a labor force is affected and in fact, beginning to increase their costs. This challenge has been compounded by the fact that labor mobility has been reduced with the standard stay in place orders that are in most countries.

3. Extraordinary Customer Requests

At this time our clients have seen a number of extraordinary customer requests which take all shapes and forms.

Renegotiate commitments

In many cases customers are looking to come back and renegotiate on their existing commitments. For example, a customer may say “yes, I’ve committed to ordering a thousand units a month, and I realize the price was predicated on me actually ordering and receiving that many units, but my market has dried up. I service the restaurant industry and I no longer need these products, so I’d like to renegotiate my commitments so that I’m not penalized if I don’t put these orders in. I also want to ensure that my price doesn’t change in the future if I don’t meet these commitments now.”

Demand a price reduction

The Pricing Solutions team has many clients with customers who are demanding a price reduction. Walmart is famous for this in past crises. We’ve started to see this more and more across the board where companies are just sending out a memo that says, “Please expect a 5% reduction in your invoice next month going forward until the crisis ends.”

In these cases, there is no negotiation. The customer is literally stating that they’re expecting a 5% or 10% or 20% price reduction.

Extend payment terms

Many customers are requesting extended payment terms, saying “I can’t afford to pay this now, but if you can start to finance me, that would make it a lot easier for me to continue to be in business and purchase your products.”

Keep in mind that for each 30 days that you extend somebody’s payment, you’re effectively giving them a 1.5% price reduction. That’s based on an 18% average weighted cost of capital that most companies deploy (divide 18 by 12 months to get 1.5%). That’s what it costs you to extend somebody’s invoice from 30 days to 60 days or to go from 60 days to 90 days. So moving someone’s payment terms from 30-90 days…that’s a 3% discount! So, when we’re talking about the value of 1%, you can see how quickly discounts can add up if you’re not diligent about extending payment terms. If you don’t do your homework you can quickly lose 1.5% by just extending somebody’s payment terms from 30 days to 60 days.

Waive agreed upon terms

Waiver of terms is a request we’re starting to see more frequently. Again, this includes everything from payments to commitments to order size to change orders to mixed orders. All the things that we see in the terms and conditions of a relationship.

Some pricers may point out that all these terms have nothing to do with the product being priced, but they do because pricing is based on value. Know that customers typically don’t just buy products, they also buy the relationship. That relationship includes all of the above mentioned terms, plus relationship management, the website, the call center, customer support, etc. The whole value proposition is more than the product, it is that relationship, which makes these terms very important because they Impact costs as well as value.

For example, one of our clients is an industrial services company that serves both industrial and city customers. With tax revenue way down, their municipal clients were asking for a commensurate reduction in pricing (often over 20%). These municipalities were saying “I can’t continue to pay, so I’d like you to take a 20% reduction which is in line with the impact felt by the city.” The problem for our client is that this would effectively eliminate all profits. This request was presented as a take it or leave it scenario. Our client asked us if there was a way to help the municipalities meet their revenue shortfall without such a high impact on profits.

After working with our client, we recommended that our client offer another deal to the municipalities. If they paid 80% now then our client would agree to finance the remaining 20% interest free for 12 months, until tax revenue was recovered. This negotiation reduced the requested discount from 20% to 3.6%. In this case our client saved not just 1% but almost 16%, which has a huge impact on the bottom line.

Ultimately, how your company addresses all of the different scenarios involved around changes in demand, cost spikes and customer requests is critical to establishing short term success. It’s also critical to avoid being locked into a long-term situation where it takes years to recover the price reductions your company has made.

At Pricing Solutions, our team is helping clients navigate the intricacies involved with the COVID-19 crisis . We are committed to equipping our clients with the pricing tools and guidance they need to implement changes confidently so they can make the best of these uncertain times. Call us today to discuss solutions to your unique pricing challenges.

You may also be interested in this article: 5 Steps to Improving your Pricing Strategy during COVID-19 : Value of 1%

Follow us on LinkedIn!